Kenya is preparing to reopen talks with the International Monetary Fund (IMF) in a bid to secure billions of shillings as the economy struggles under mounting pressure.

Prime Cabinet Secretary Musalia Mudavadi confirmed that the National Treasury is finalizing plans for negotiations aimed at creating a structured programme to guide the country’s economic direction. He told diplomats in Nairobi that “the government of Kenya, through the Treasury, will be engaging with the IMF so that we can work on a new programme.”

This move comes less than a year after Kenya failed to complete a previous IMF programme worth $3.6 billion (Ksh465 billion). The old agreement expired in April, and the country missed out on the final $850 million (Ksh109.9 billion) disbursement after failing to meet key conditions such as reducing the budget deficit and raising additional taxes.

Analysts warn that securing new IMF financing will not be straightforward, as Kenya may need to settle part of its existing debt before qualifying for a fresh programme. Even if talks begin soon, a final deal may not be reached before 2027.

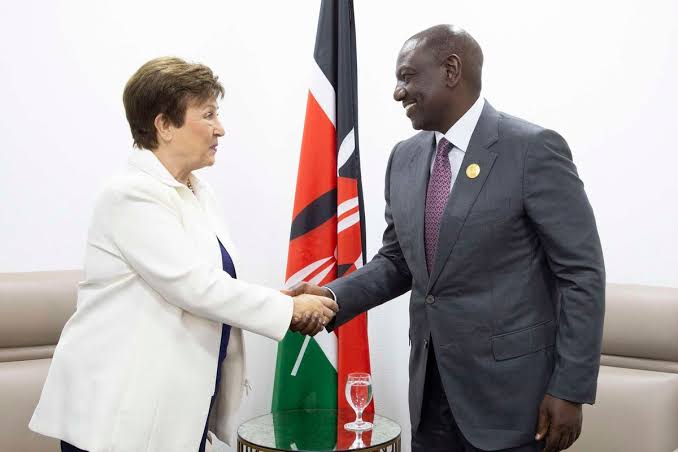

The Ruto administration views IMF support as crucial for managing the country’s ballooning debt and external obligations. Kenya has Eurobonds maturing in the coming years and limited foreign exchange reserves.

A new programme could provide financial guarantees that allow the government to refinance bonds, service existing loans, and unlock money from other global lenders. Mudavadi said discussions will focus on financing development priorities, but critics argue much of any new funds will likely go to debt repayments rather than improving services for ordinary Kenyans.

Beyond the IMF, the Treasury is exploring other sources of funding, including diaspora bonds, privatisation of state corporations, and refinancing local and foreign bonds. However, these alternatives cannot match the scale of support that IMF-backed financing provides.

Kenya’s relationship with the IMF has always been controversial, as loan conditions often include austerity measures, higher taxes, and spending cuts.

Many Kenyans are already feeling the impact of new taxes introduced under the Finance Act, and another IMF programme could further strain household budgets.

International credibility also plays a role in Kenya’s urgent return to the IMF. The European Commission recently listed the country among high-risk jurisdictions for money laundering and terror financing, following the Financial Action Task Force (FATF) grey listing. Mudavadi said Treasury is working with partners and security agencies to meet compliance benchmarks, but international lenders remain cautious.

Approval for new loans will require Nairobi to demonstrate financial discipline, transparency, and good governance. Failure to do so could delay or block new funding, raising the cost of borrowing further and leaving Kenya vulnerable to financial collapse.

Add Comment