Kenya is heading into a tough economic period as new research shows the country will spend Sh5.1 billion every day on debt repayment in the 2025/26 financial year. This adds up to a total of Sh1.8 trillion for the year.

This report as shared by @moneyacademyKE on X, highlights the growing burden of public debt. By March 2025, Kenya’s domestic debt had already reached Sh6.12 trillion, marking a 26.7% increase from June 2023. If the trend continues, experts predict that the country’s public debt could climb to Sh13.2 trillion by June 2027. This situation raises serious concerns about Kenya’s financial future and its ability to fund key areas like infrastructure, healthcare, and education. The rapid rise in debt means that Kenya might have to cut back on development spending to keep up with the heavy loan repayments.

The government may resort to raising taxes or even borrowing more to manage the costs, creating a dangerous cycle of debt dependency. Already, in 2024, Kenya’s debt servicing costs had jumped to Sh1.6 trillion, including external debt payments of Sh756 billion. The pressure on the national budget is growing, and the risk of economic stagnation is becoming real. With a huge portion of the government’s income being used to pay debts, little remains for projects that could boost growth and create jobs.

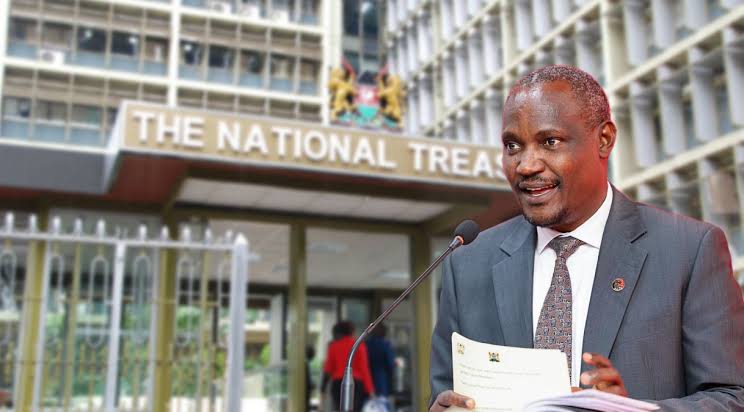

The government has promised to bring the debt-to-GDP ratio below 55% within two years, down from slightly above 58% as of March 2025. Finance Minister John Mbadi announced this plan, and it forms part of the 2025 Medium Term Debt Management Strategy released by the National Treasury.

This strategy aims to manage the risks linked to short-term borrowing and a bunching of repayments between 2025 and 2028. However, achieving this goal will be difficult given the current economic pressures, including global financial instability and weakening of the Kenyan shilling against major currencies.

Debt problems have been made worse by the type of loans Kenya has been taking. A large part of Kenya’s borrowing is short-term, and nearly 18.6% of domestic debt is due to mature by June 2025. Treasury bonds now make up over 84% of government securities while reliance on Treasury bills, which are even shorter-term, has also gone up.

External loans have not helped either, as the first quarter of the 2024/25 financial year saw an additional Sh37.5 billion in external borrowing. These dynamics mean Kenya is highly exposed to changes in interest rates and currency values, making debt repayments even more expensive.Public reactions on social media have shown deep frustration.

Many Kenyans feel that the government is trapping them in endless borrowing without real benefits to their lives. Some users sarcastically said that Kenyans have become collateral for the country’s massive loans. Others pointed out that while Kenya borrows around Sh15 billion every day, only Sh5.1 billion is used to pay debt, raising questions about where the rest goes. Worries have also been raised about how much revenue the Kenya Revenue Authority is collecting daily to support these huge repayment needs. In October 2024, KRA collected Sh208 billion against a target of Sh201 billion, but this is not enough when compared to the size of debt obligations.

Another big concern is the amount of government-guaranteed debt carried by state corporations, which stood at Sh94.2 billion in June 2024. Non-guaranteed debt for state corporations was also high, reaching Sh78.2 billion. Combined with pending bills amounting to Sh379.8 billion, these liabilities could further stretch government finances if the corporations fail to meet their obligations.

The rising debt and its related challenges paint a grim picture for Kenya’s economic future. While the government has outlined a strategy to manage the debt, including plans to improve revenue collection and reduce expenditure, many analysts believe that more aggressive action is needed. Without a clear plan to create real economic growth and cut wastage, Kenya risks being stuck in a cycle where most of its resources go into paying old debts rather than building a better future. The situation demands honest leadership, tough decisions, and a commitment to put the country’s long-term stability first.

Add Comment