Safaricom’s financial empire continues to grow, but questions around its accountability and reliability are becoming louder.

Millions of Kenyans depend on M-Pesa and M-Shwari for their daily financial needs, yet recent disruptions have exposed deep cracks in how the company manages its digital banking operations. M-Shwari, a joint product of Safaricom and NCBA Bank, was introduced in 2012 with the promise of giving ordinary Kenyans access to savings and loans straight from their phones.

Over the years, it has become the backbone of mobile banking, handling billions of shillings in transactions every month. But when technical failures strike, the consequences are immediate and painful, especially for low-income users who depend on the service to meet daily expenses.

M-Shwari operates under NCBA’s banking license and has grown to serve millions of customers across Kenya. For many, it is their only link to formal banking.

The partnership between Safaricom and NCBA has long been praised as an innovation that changed Kenya’s financial landscape, but the cracks are showing.

Users have faced recurring outages that lock them out of their savings or prevent loan access when needed most. Safaricom often calls these “temporary disruptions,” yet they reveal a pattern of unpreparedness in managing a service that moves hundreds of billions of shillings.

For a company that dominates the mobile money market, such repeated lapses raise questions about its investment in system stability and customer protection.

Critics say Safaricom’s response to these failures has been slow and dismissive. When M-Shwari goes down, communication from the company is minimal usually limited to vague social media replies promising that the issue is “being fixed.”

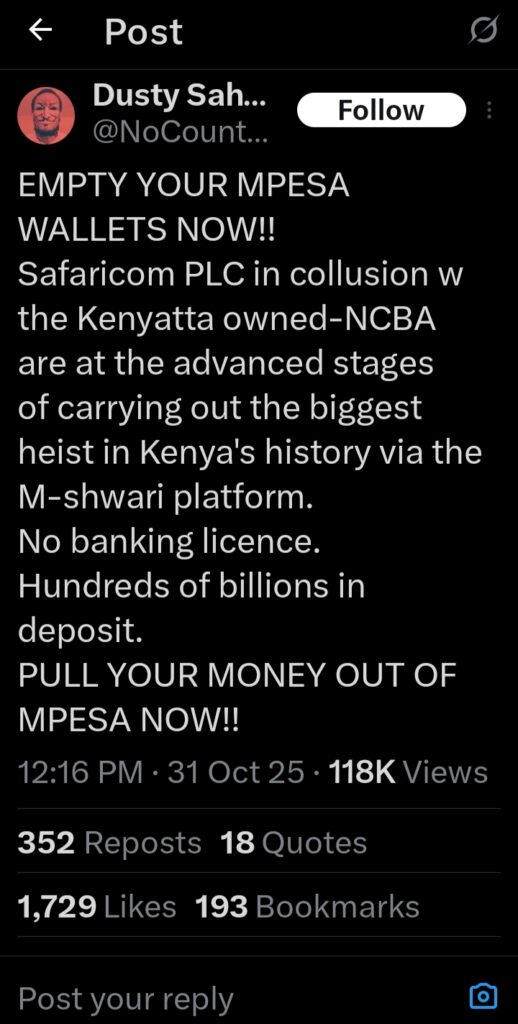

There is rarely a clear explanation of what went wrong or when the problem will end. This lack of transparency fuels public distrust, especially when people’s savings vanish temporarily or when account balances fluctuate without reason.

NCBA, which provides the banking backbone, has also been accused of keeping silent during such crises, leaving Safaricom to absorb public anger while customers remain in the dark about the safety of their funds.

The Central Bank of Kenya has repeatedly emphasized that digital financial services must meet the same standards of accountability as traditional banks.

But Safaricom’s massive control over mobile transactions gives it an unfair advantage that appears to go unchecked. When technical failures affect millions, there is little recourse for the average user.

The situation is even more worrying considering that Safaricom and NCBA are private entities managing what effectively functions as a national financial infrastructure.

With over 50 million active users and trillions in annual transaction value, any weakness in their systems risks paralyzing the country’s economy.

Safaricom’s dominance has also made it difficult for competitors to challenge its position or push for better standards. Users have limited options, meaning even when services fail, they are forced to wait.

The company’s repeated technical breakdowns show that its infrastructure has not evolved fast enough to handle the growing pressure of daily transactions.

And while the company continues to expand its reach venturing into Ethiopia and other markets the same energy is not being directed toward strengthening its existing platforms at home.

The partnership with NCBA remains profitable, but profit without reliability comes at a cost. Kenyans need assurance that their savings are secure, that their transactions are accurate, and that they will not be cut off without warning.

Safaricom and NCBA cannot continue treating outages as mere inconveniences when they directly affect livelihoods. These are not just technical issues they are failures of responsibility and communication.

Add Comment