Digital banking outfit Loop, operated by NCBA Group, is now facing serious questions after new claims of unfair treatment of its temporary staff.

A brand ambassador working under its Flex Project says she was suddenly fired without pay, even though she had a valid contract and had worked for the company the entire period in question.

The problem, according to her, came from a mistake she made during onboarding months ago. Despite continuing her work without any issue being raised at the time, Loop later used that old mistake as the reason to terminate her contract and deny her payment.

She was among the many field ambassadors Loop relies on to push its digital banking product and sign up merchants. But in her case, she says she wasn’t given a chance to explain or correct anything.

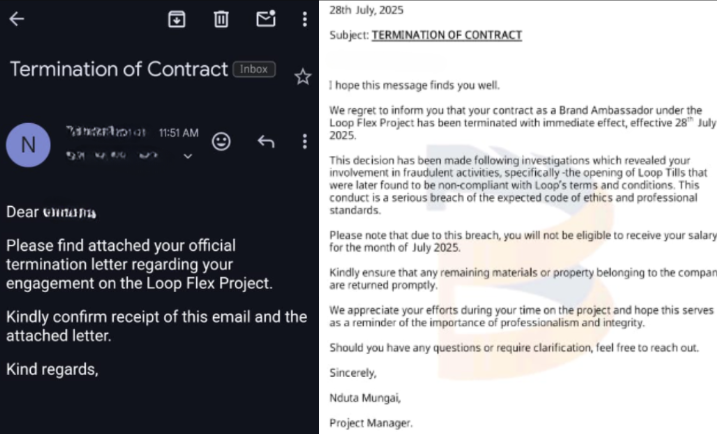

There was no official warning or meeting. She simply received a termination letter dated 28th July 2025, signed by a project manager in the Loop Flex program.

The letter claimed she had opened Loop Tills that didn’t meet the company’s internal rules, which they labelled as fraud.

This was used to justify not just her removal, but also the refusal to pay her for the entire period she had worked in July.

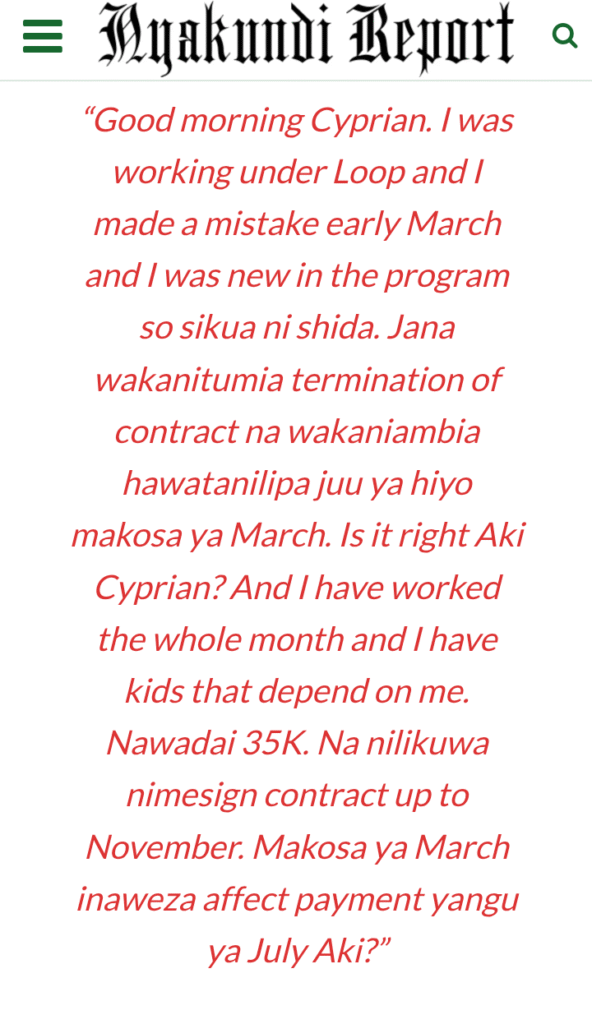

She reached out to whistleblower Cyprian Is Nyakundi to express her frustration, stating, “Good morning Cyprian. I was working under Loop and I made a mistake early March and I was new in the program so sikua ni shida. Jana wakanitumia termination of contract na wakaniambia hawatanilipa juu ya hiyo makosa ya March. Is it right Aki Cyprian? And I have worked the whole month and I have kids that depend on me. Nawadai 35K. Na nilikuwa nimesign contract up to November. Makosa ya March inaweza affect payment yangu ya July Aki?”

This message has now sparked quiet anger within the fintech sales space. Many in similar roles are beginning to question how secure their positions really are and whether such treatment could happen to them too. People familiar with how Loop operates say this is not the first time the company has handled internal issues this way.

They argue that the company’s actions in this case fall short of basic fairness.

If someone makes a mistake during onboarding but continues to work normally and is never told anything is wrong, it is unfair to later use that mistake as an excuse to fire them and deny their pay.

What makes this case even more troubling is how the letter blends a tone of finality with moral judgment. It says the termination is a lesson in “professionalism and integrity,” yet gives no signs of following proper procedures such as hearings or official warnings.

For people working under temporary or contract terms in digital banking roles, this raises deep concerns about how companies like NCBA’s Loop handle discipline and fairness.

Whether this was a one-off decision or a glimpse into a wider problem in how Loop treats its ground staff is still unclear. But the message it sends is already causing worry among those who depend on these roles to support their families.

Add Comment