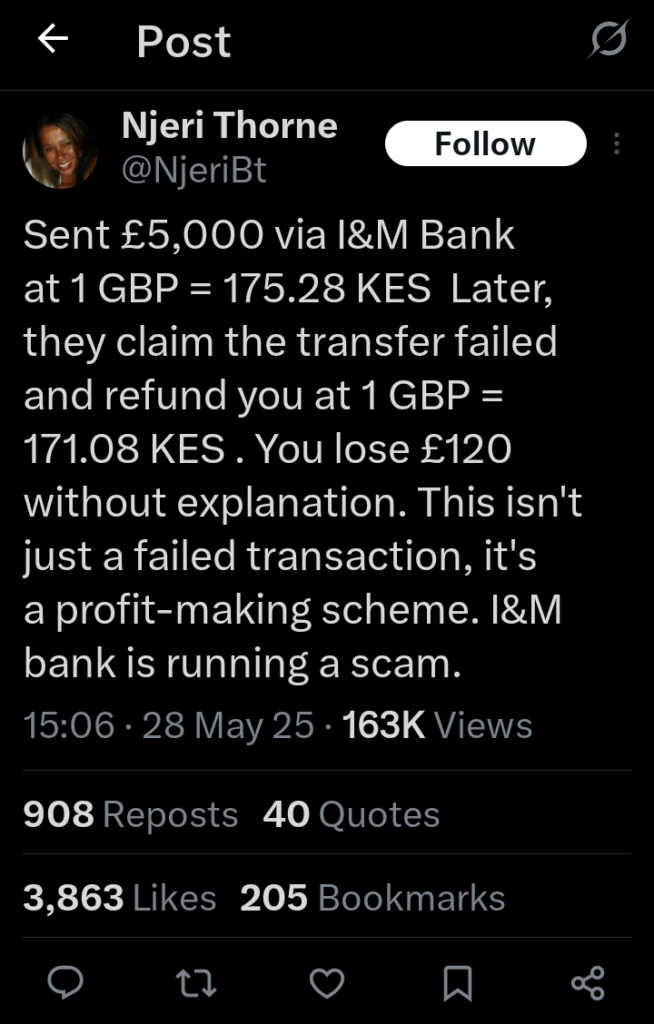

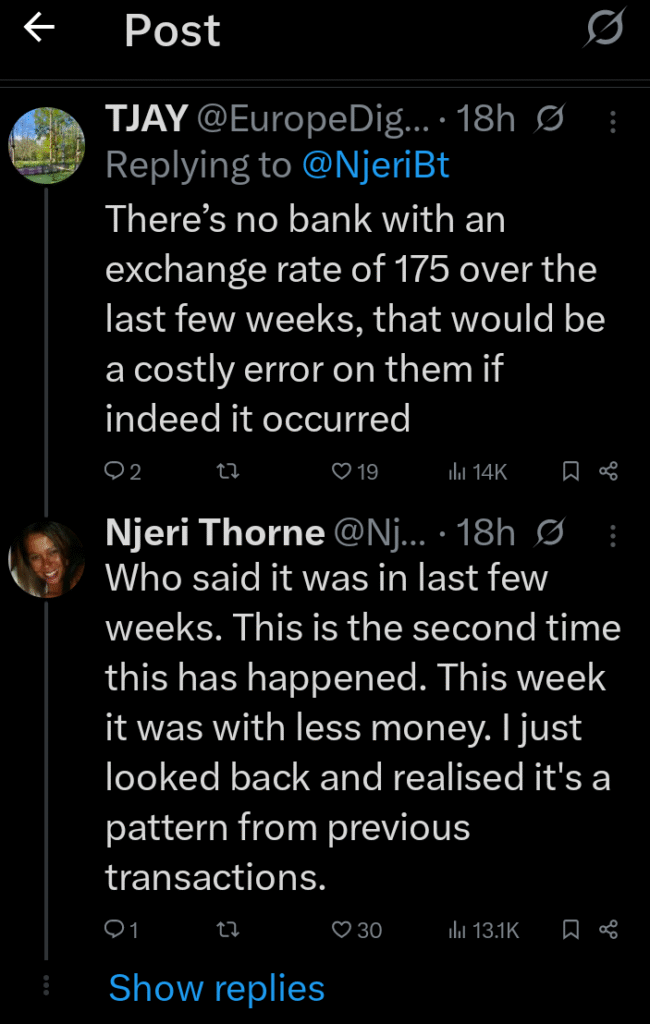

A recent case involving I&M Bank has raised serious concerns among customers about how failed international transfers are handled. A customer named Njeri Thorne shared her experience on X, where she explained how she tried to send £5,000 through I&M Bank at an exchange rate of 1 GBP to 175.28 KES.

The transaction failed, but when the bank refunded the money, they used a lower exchange rate of 1 GBP to 171.08 KES. This resulted in a loss of about £120, which the bank did not explain. What upset the customer most was not just the failure of the transaction, but that she didn’t get back the full amount she had sent in the first place.

When you look at the math, it becomes clear what happened. The original transaction was worth 876,400 KES, based on the initial exchange rate. But the refund only amounted to 855,400 KES, creating a shortfall of 21,000 KES.

When converted back to pounds at the original rate, that’s around £120 lost. For many people, this doesn’t feel fair especially because the transaction didn’t go through. Customers expect to be refunded the full amount they spent when something goes wrong, especially when it’s not their fault.

Looking into how banks normally handle these situations, it seems they often use the exchange rate at the time of the refund rather than the original rate. That might make sense for successful transactions or returns made later, but when the transaction didn’t even happen, using a lower rate feels more like a trick than a policy.

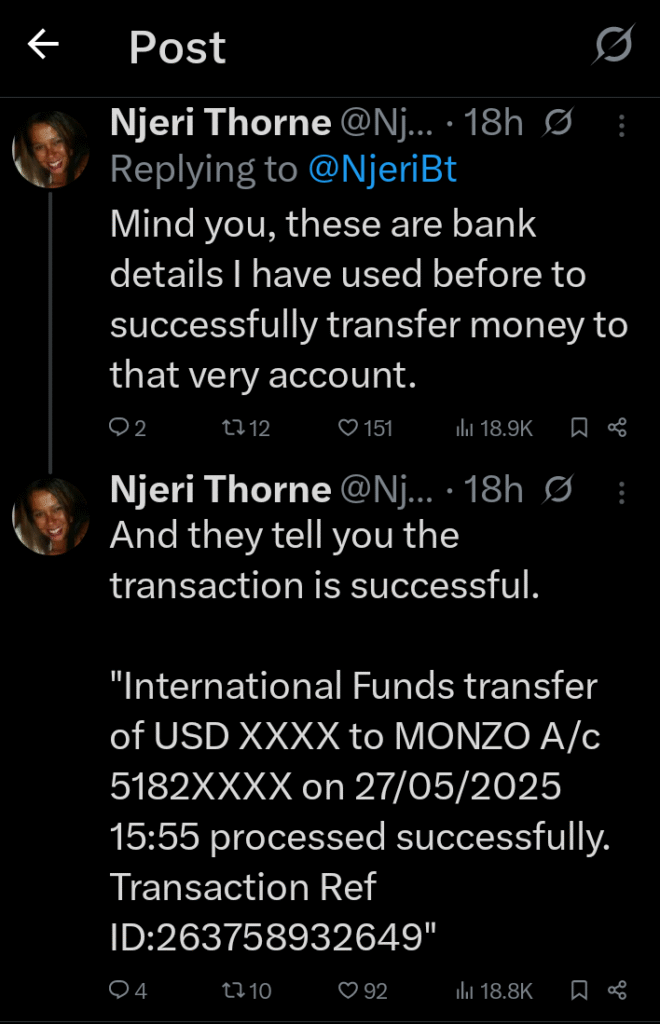

I&M Bank hasn’t offered a clear explanation, which only makes things worse. Their terms and conditions are vague and don’t directly explain how refunds for failed international transfers are calculated. Without clear rules or proper communication, customers are left confused and frustrated.

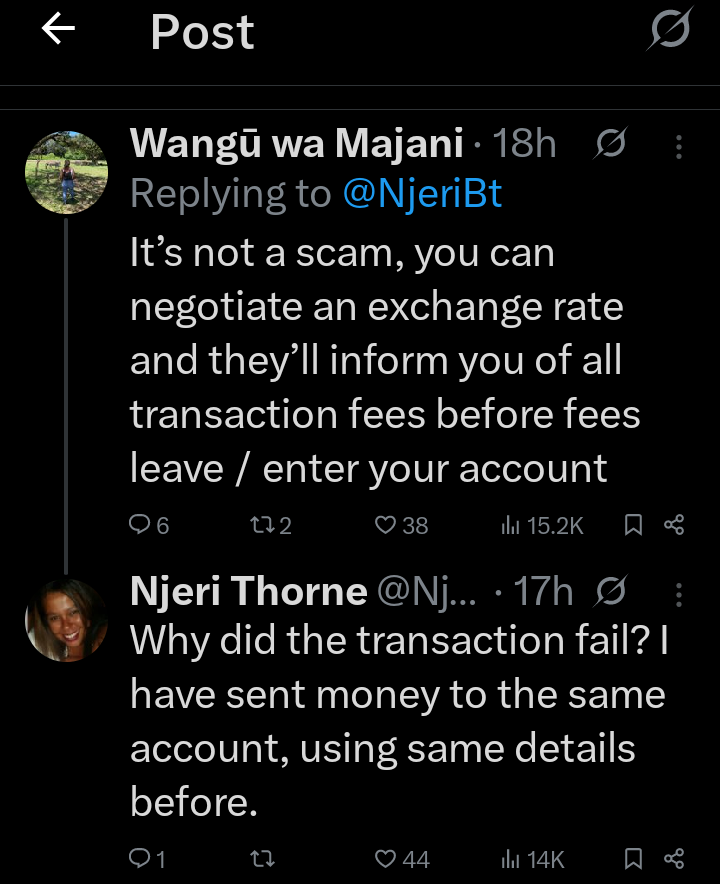

A number of people responded to Njeri Thorne’s post, with some advising her to speak to a relationship manager and others calling for better treatment of customers.

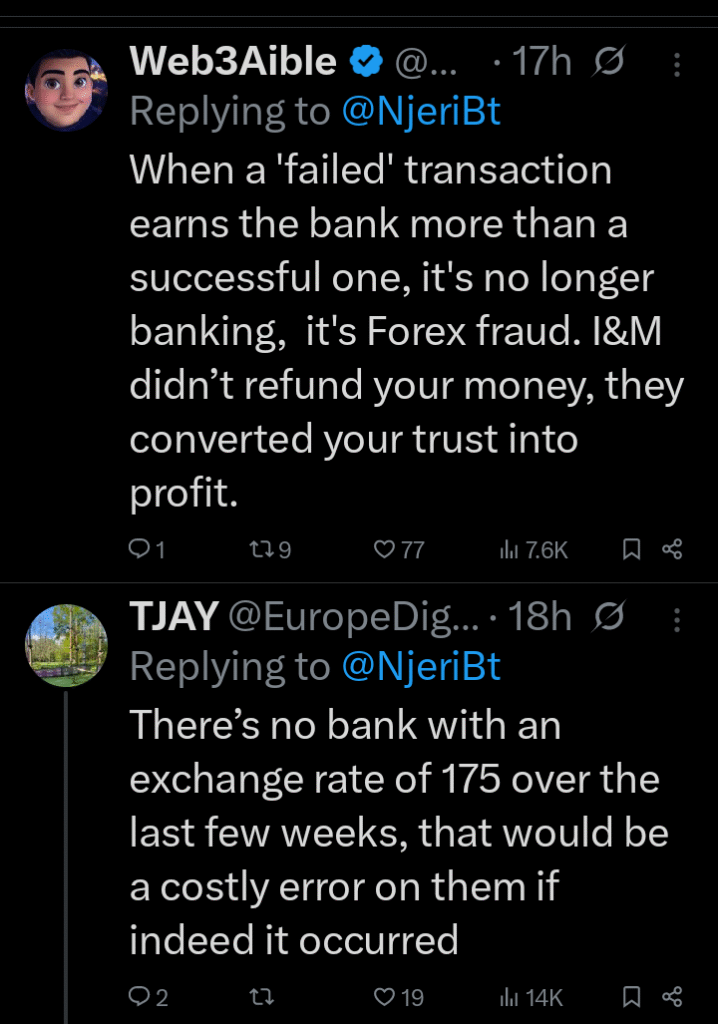

This shows that she’s not alone in her frustration. People are becoming more aware of these issues and are starting to question whether banks are acting in their best interest. There’s a growing concern that I&M Bank, in this case, may have used the situation to make a small profit by refunding at a less favorable exchange rate.

Even if it’s technically allowed, it doesn’t sit right with customers. The exchange rate on the day of the transaction, according to market data, was around 174.49 KES to 1 GBP, which means the rate used by I&M Bank for the original transfer was already slightly higher. But the rate they used for the refund was even lower than the bank’s own published buy rate two days later, which was 171.62.

This raises more questions. Why was the refund rate 171.08? And why was there no explanation provided to the customer? It’s this lack of transparency that turns a technical issue into a trust issue.

Customers need to know how their money is being handled, especially when dealing with large amounts and international transfers. A failed transaction should not result in financial loss. At the very least, the bank should explain how they arrived at the refund amount.

Until banks like I&M are clear about their processes, customers will continue to feel cheated. For now, those who experience similar issues are advised to carefully review their bank’s refund policies and lodge formal complaints if necessary. Public sharing of such cases may help pressure banks to act more fairly.

Add Comment