Kenya is reportedly in the final stages of negotiating a massive KSh 194 billion loan from the United Arab Emirates (UAE) through International Holding Company (IHC), a conglomerate with close ties to the controversial Adani Group.

This loan is intended to help bridge Kenya’s growing budget deficit, which has been a challenge for the government.

The loan is tied to IHC’s subsidiary, Apeiro Limited, which is involved in the healthcare sector.

Apeiro is set to roll out the Integrated Healthcare Technology System (IHTS) under the Social Health Authority (SHA) framework.

This project, valued at over KSh 104 billion, aims to support Kenya’s Universal Health Coverage agenda.

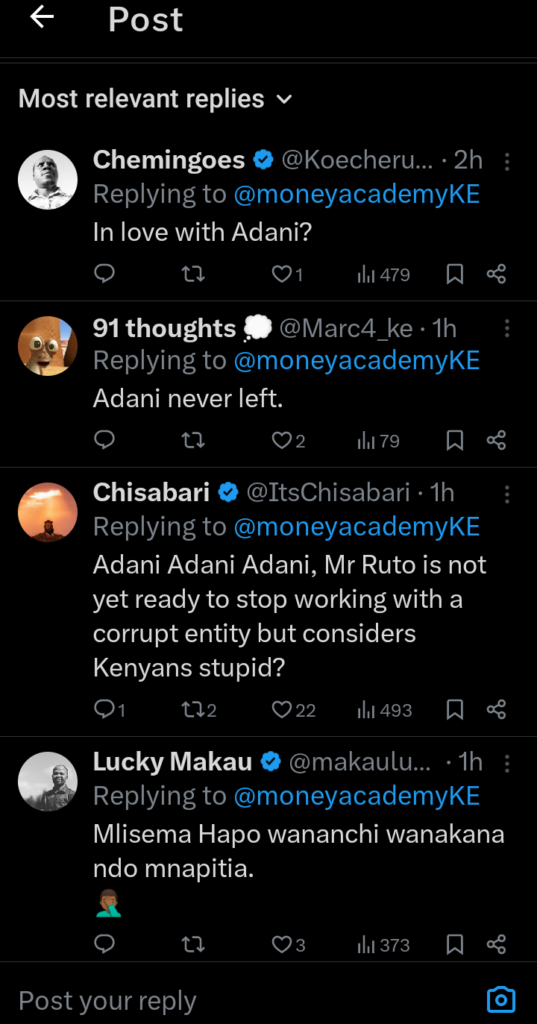

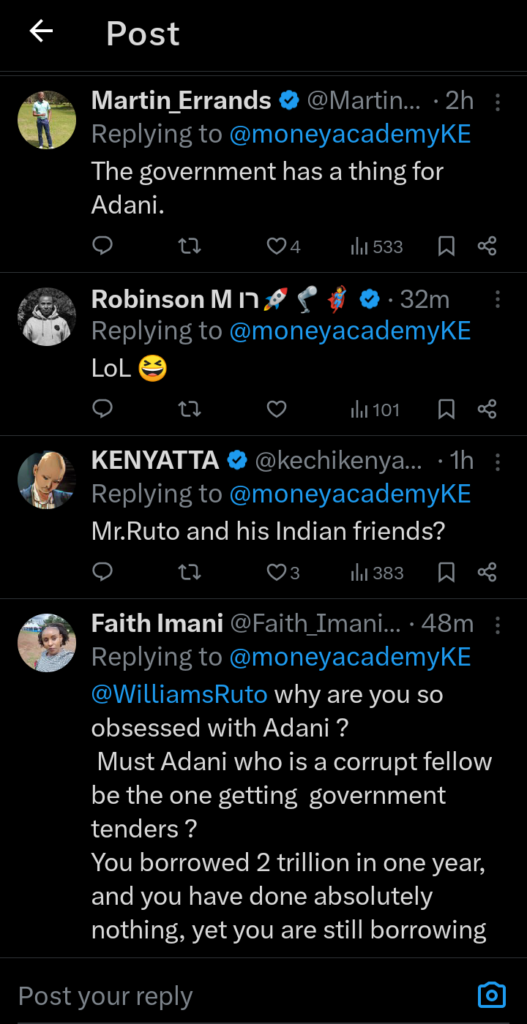

While the project is seen as a step toward improving healthcare in Kenya, the involvement of IHC and its Adani connections has sparked questions about transparency and the influence of foreign entities in critical sectors like healthcare.

This deal is not the first time Adani-linked investments have raised concerns in Kenya.

Previously, the Adani Group has been involved in energy and infrastructure projects, such as the management of Jomo Kenyatta International Airport (JKIA).

These projects have faced criticism due to the perceived lack of proper due diligence and concerns over the monopolization of vital sectors by foreign companies.

The SHA initiative, in particular, has raised alarms about the accountability of public funds, as well as the risks of outsourcing essential public services to foreign companies with questionable reputations.

Critics argue that Kenya’s increasing reliance on foreign loans and partnerships is undermining public trust in the government.

The involvement of Safaricom in the SHA project has only added to the controversy.

The company’s chairman, Adil Khawaja, has reportedly ties to the Adani Group, further blurring the lines between corporate and public interests.

This situation has prompted calls for greater oversight, as many believe that such partnerships could lead to a loss of control over key public services.

Kenya’s debt burden has been steadily increasing, and the government’s reliance on high-interest loans is becoming more pronounced.

The situation has been worsened by delays in disbursements from the International Monetary Fund (IMF), leaving Kenya in a precarious financial position.

With the country’s budget deficit expected to widen further, many fear that the government will continue to depend on loans and privatization of key sectors to stay afloat.

While the government defends these deals as necessary to address fiscal shortfalls and modernize public services, the long-term consequences for transparency, national sovereignty, and public accountability are worrying.

The involvement of IHC and its links to the Adani Group in Kenya’s healthcare system highlights the risks of prioritizing short-term financial solutions over sustainable and transparent development strategies.

With the country’s financial future at stake, it is clear that stronger safeguards are needed to protect Kenya’s resources and ensure that foreign influence does not undermine the public interest.

Add Comment