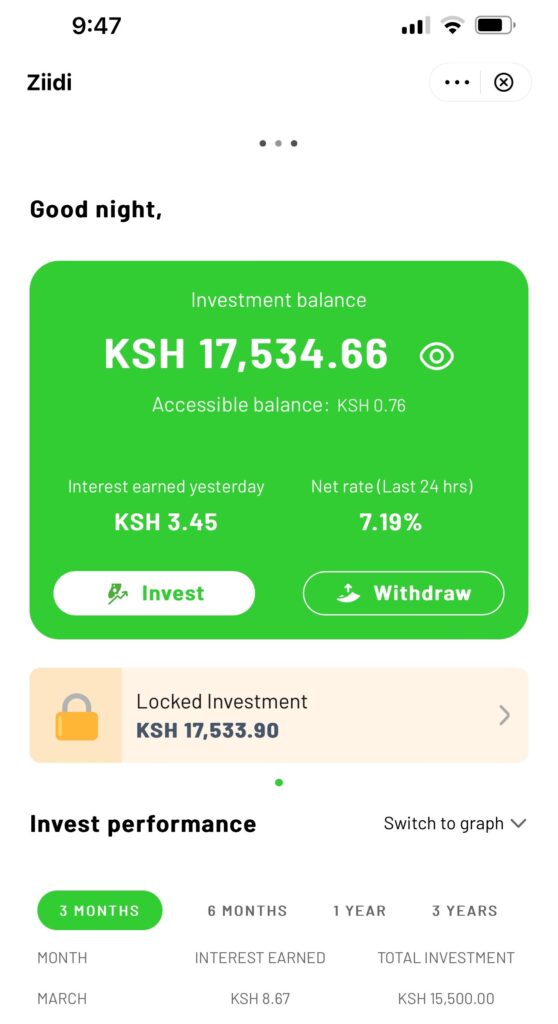

Money Market Funds (MMFs) have been sold to Kenyans as an easy way to grow their money with minimal risk. Safaricom’s Ziidi is one of these MMFs, promising users a secure place to park their cash while earning interest.

However, many Kenyans are now realizing that these so-called investments might be nothing more than a scheme to lock up their money while offering returns that are laughably low.

The reality is setting in, and people are starting to ask tough questions about whether MMFs are even worth the effort.

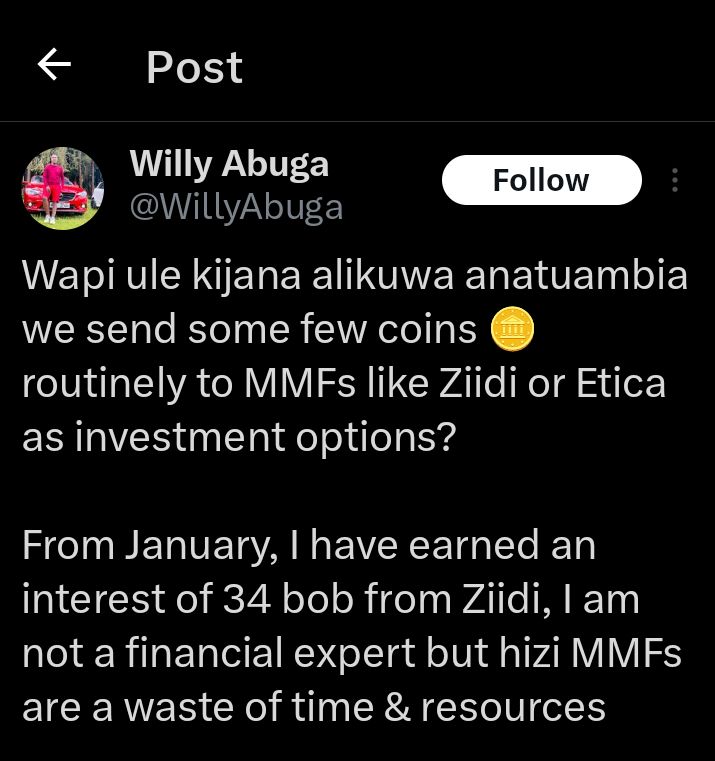

Willy Abuga, a vocal critic on social media, recently exposed the disappointing returns from Safaricom’s Ziidi on his X handle. He revealed that since January, he has earned a mere 34 shillings in interest.

This revelation has sparked a wider conversation about whether MMFs, especially Ziidi, are anything more than a waste of time and resources.

Many Kenyans had trusted Safaricom, believing that Ziidi would be a reliable place to invest their hard-earned money, only to realize that the returns are barely enough to buy a packet of milk.

The frustration is justified, especially considering that Safaricom, a company that rakes in billions in profits, is running a financial product that delivers such miserable returns to its users.

The decline in MMF interest rates across the board has been a concern, but Ziidi seems to be one of the worst performers. When Safaricom launched this product, they marketed it as an innovative solution to help Kenyans grow their savings.

But now, the only ones growing wealth appear to be Safaricom and its partners, while ordinary Kenyans are left with peanuts.

This situation raises serious concerns about how financial products are regulated in the country and whether Safaricom is using its dominant position to exploit unsuspecting Kenyans.

What makes this worse is that Ziidi is deeply integrated with M-Pesa, making it easy for Safaricom to collect funds from users without offering them any real value in return.

People are locking up their money for months, hoping for a meaningful return, only to get a few shillings in interest. Meanwhile, Safaricom continues to enjoy the benefits of holding billions in customer deposits.

This is nothing short of a scam disguised as an investment opportunity. Kenyans need to wake up and realize that putting money into Safaricom’s Ziidi is no better than storing it in a regular M-Pesa wallet.

At this rate, it would be better to explore alternative investment options instead of letting Safaricom continue to milk them dry.

Add Comment