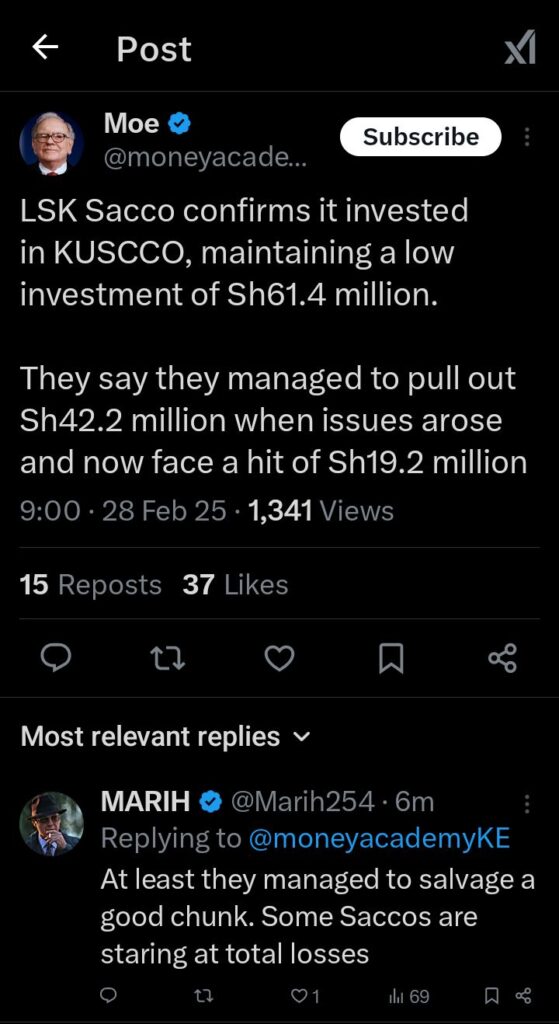

LSK Sacco confirms it invested in KUSCCO, maintaining a low investment of Sh61.4 million. They say they managed to pull out Sh42.2 million when issues arose and now face a hit of Sh19.2 million.

This was revealed by MOE on X, who shared details of the investment, sparking fresh concerns over the stability of SACCOs and their exposure to financial risks.

MOE’s post has drawn attention to how SACCOs are handling investments and whether members’ funds are truly safe. LSK Sacco, like many others, trusted KUSCCO with its money, expecting stable returns.

However, the financial challenges that hit KUSCCO forced them to act quickly, managing to withdraw part of their investment before things got worse.

Despite this, they could not recover the entire amount, leaving them with a Sh19.2 million loss.

KUSCCO has been facing liquidity issues, affecting SACCOs that invested in it. Many institutions are now struggling to explain to their members why funds meant for loans and savings are stuck. The case of LSK Sacco is just one example of how SACCOs are losing money due to risky investments.

MOE’s revelation has now raised questions about how SACCOs choose where to invest and whether enough due diligence is done before placing members’ funds in such institutions. For ordinary SACCO members, this is worrying news. Many people trust SACCOs because they believe their money is safer there than in banks.

But if SACCOs continue to lose money in such investments, members may start pulling out their savings, which could weaken the entire sector. The government and financial regulators must act fast to protect SACCOs from risky investments and ensure that institutions like KUSCCO are properly managed.

MOE’s post has also led to discussions on whether SACCO leaders should be held accountable for losses. If proper risk assessments were done, would LSK Sacco and others have invested in KUSCCO? Were there warning signs that were ignored?

These are questions that SACCO members and financial experts are now asking. Without strict regulations and oversight, SACCOs could continue to lose millions, hurting thousands of Kenyans who rely on them for loans and savings

.The Sh19.2 million loss by LSK Sacco may not be the largest financial hit in the sector, but it is a clear sign that more needs to be done.

Add Comment