According to the Nation newspaper, CMC Motors, a well-known automotive dealership operating in Kenya, Uganda, and Tanzania, is closing its operations.

With many Kenyans attributing the closure to the country’s challenging business environment.

A big number of people believe that the high taxes imposed by President William Ruto’s government are the main reason for the shutdown.

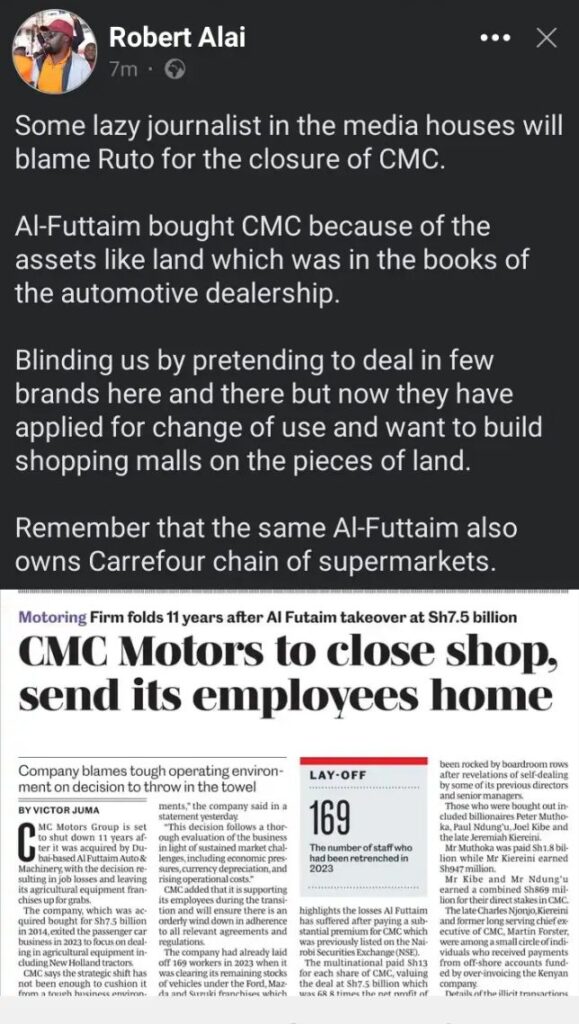

However, Robert Alai, a blogger and Member of the County Assembly (MCA) for Kileleshwa, has raised other concerns that go beyond just the tax issue.

Alai, known for his outspoken opinions, has pointed out that some journalists are likely to blame Ruto for the company’s closure.

However, he believes this is an oversimplification of the issue.

In his view, the real reason behind the closure is tied to Al-Futtaim, the company that purchased CMC Motors.

Alai claims that Al-Futtaim’s interest in the company wasn’t based on its automotive business but rather its valuable assets, particularly the land held by CMC Motors.

According to Alai, the automotive dealership was not aplayer in the market, and its owners were merely pretending to be involved in selling a few car brands.

Alai further revealed that Al-Futtaim had already applied for a change of use for the land under CMV’s ownership.

Instead of continuing with the automotive business, the company plans to develop shopping malls on these prime plots of land.

This, Alai argues, is part of a broader strategy by Al-Futtaim to shift its focus from car sales to retail developments.

He also reminded the public that Al-Futtaim is the same conglomerate that owns Carrefour, a popular supermarket chain in Kenya and other parts of the region.

While many continue to point fingers at Ruto’s administration for the business closure, Alai’s claims suggest that the closure of CMC Motors is part of a more strategic move by Al-Futtaim to take advantage of valuable land assets rather than a direct result of Kenya’s taxation policies.

His statements highlight how international corporations might be using local businesses as vehicles to secure land for future developments, which could potentially benefit them more than continuing operations in industries like automotive sales.

This serves as a reminder of the complexities behind business closures in Kenya and the role that corporate strategies play in these decisions.

While Ruto’s taxes may have contributed to a difficult business climate, Alai’s revelations about Al-Futtaim’s real intentions may shift the focus from national policies to the broader global business tactics at play in the region.

Add Comment