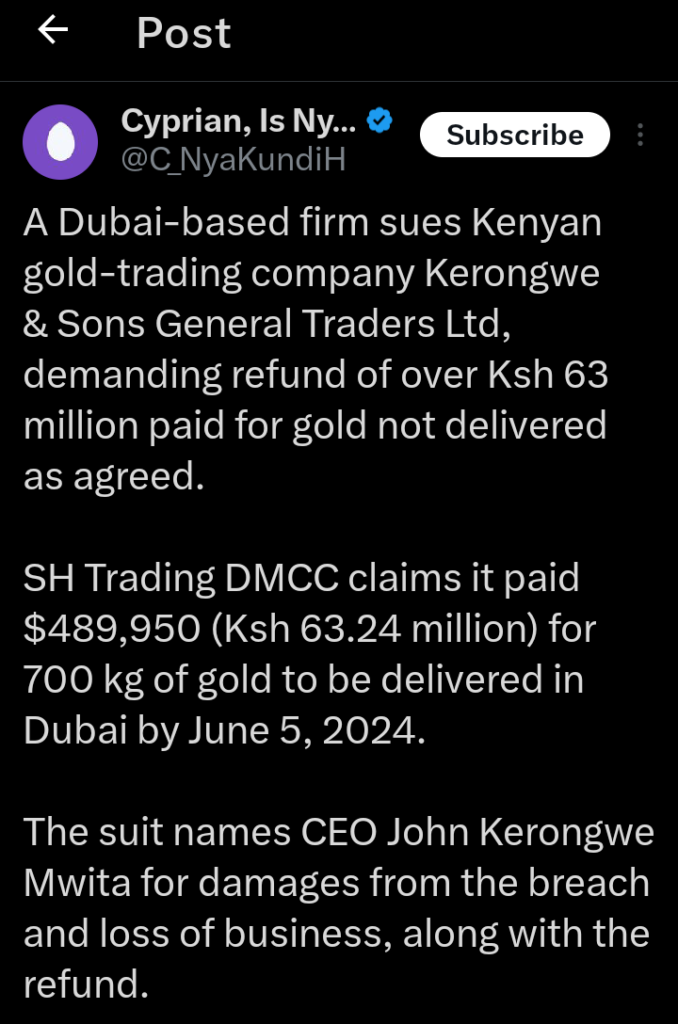

A firm based in Dubai, SH Trading DMCC, has initiated legal proceedings against Kenyan company Kerongwe & Sons General Traders Ltd and its CEO, John Kerongwe Mwita.

The suit demands reimbursement of over Ksh 63 million (around $489,950), which was paid for 700 kilograms of gold that were never delivered as per their agreement.

SH Trading DMCC, which focuses on sourcing and importing gold for medical applications, ventured into Kenya to establish partnerships with key players in the gold industry.

The company was introduced to Kerongwe & Sons through contacts reportedly linked to Kenya’s Ministry of Mining, which bolstered SH Trading’s confidence in the partnership.

As part of the negotiations, representatives of SH Trading were shown approximately 720 kilograms of gold.

To ensure its authenticity, a sample of 63.5819 grams was analyzed, allegedly with the involvement of the Ministry of Mining.

The gold was verified as genuine, and an evaluation certificate dated May 24, 2024, was issued.

This prompted SH Trading to enter a formal agreement for the supply of gold.

Physical inspections of the bars were conducted at Kerongwe & Sons’ office in Spring Valley, Nairobi.

Following these assurances, SH Trading transferred $489,950 through various payment methods, including cash and bank transfers.

The contract stipulated that 700 kilograms of gold would be delivered to Dubai by June 5, 2024.

However, the shipment did not materialize, and repeated demands for the delivery yielded no results.

The failure to fulfill the contract has reportedly caused substantial disruptions to SH Trading’s operations, leading to significant financial losses.

The company estimates that the missing gold, valued at approximately $28 million, has severely impacted its supply chain, manufacturing processes, and ability to meet client demands.

In response to the breach, SH Trading has filed a lawsuit seeking a full refund of the $489,950, along with interest and compensation for damages resulting from the breach of contract.

The case targets both Kerongwe & Sons and its CEO as defendants.

SH Trading intends to present evidence, including visual documentation of the gold bars at the Nairobi office, to substantiate its claims.

Kerongwe & Sons General Traders Ltd markets itself as a licensed gold dealer with interests in mining operations in Migori and a warehouse in Nairobi housing gold reserves.

Despite these claims, the lawsuit raises questions about the company’s business integrity and reliability in fulfilling contracts.

This case underscores the complexities and risks inherent in international gold trade, highlighting the critical importance of thorough verification and due diligence.

The lawsuit’s outcome could have far-reaching implications for the gold trade between Kenya and foreign partners, influencing future transactions and trust within the sector.

Add Comment