Whitepath Company Limited has become a name synonymous with predatory lending, harassment, and blatant disregard for consumer rights.

Despite being penalized by the Office of the Data Protection Commissioner (ODPC) in April 2023 for numerous violations, including unsolicited texts and harassment, the company has not only ignored these penalties but has escalated its aggressive tactics.

Borrowers and their contacts continue to bear the brunt of Whitepath’s unchecked exploitation, revealing the true extent of their unethical operations.

A whistleblower has exposed shocking practices within Whitepath, painting a grim picture of desperation and exploitation.

The company imposes an exorbitant 35% interest rate per week on borrowers, a rate that is not just financially crippling but exploitative by all standards.

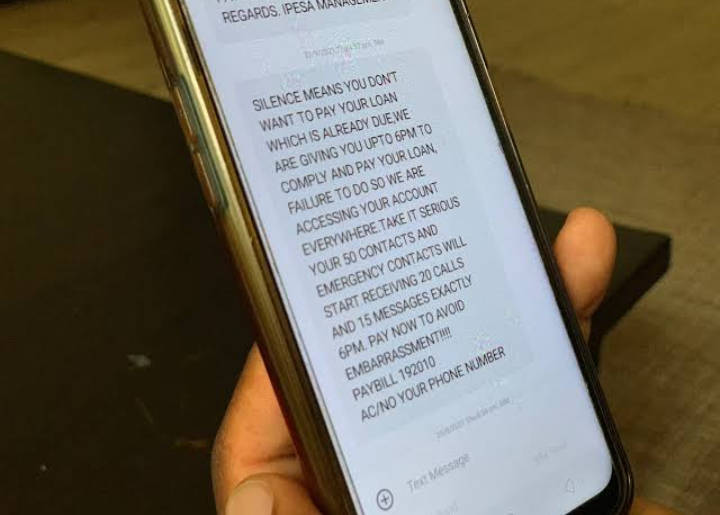

For those who fail to meet these impossible repayment terms, the company immediately targets their contacts with threatening messages.

These messages are designed to intimidate and shame, creating a ripple effect of embarrassment and distress for borrowers and their families.

Reports indicate that Whitepath’s actions have pushed many borrowers into severe emotional distress, with some experiencing suicidal thoughts due to relentless harassment.

Borrowers continue to wonder how Whitepath gains access to their contacts, a violation of privacy that further exacerbates the trauma they endure.

An anonymous victim highlighted the extent of Whitepath’s predatory behavior in a plea for help.

According to the victim, Whitepath uses blackmail and harassment as tools to recover debts.

Borrowers are not the only ones affected; their friends, colleagues, and relatives are dragged into the ordeal through unsolicited and often abusive messages.

Such practices not only destroy trust but also create rifts in personal relationships, amplifying the borrowers’ suffering.

Whitepath’s audacity to persist in these practices, despite regulatory penalties, raises suspicions about the company’s ownership and potential connections.

Its unwillingness to disclose how it accesses borrowers’ contacts points to a deeper breach of data protection laws.

This lack of transparency, combined with predatory lending rates and harassment, paints a picture of a company operating with impunity.

As complaints pile up, it becomes evident that Whitepath thrives on the vulnerabilities of its clients.

The ODPC’s actions, while commendable, have proven insufficient in curbing the company’s rogue behavior.

Stronger measures, including criminal investigations and stricter penalties, are necessary to hold Whitepath accountable for the emotional, financial, and psychological harm it continues to inflict.

Whitepath Company Limited has shown that it has no regard for ethical business practices, consumer protection, or even basic human decency.

Its predatory tactics have left countless individuals in despair, and its blatant defiance of regulatory warnings highlights the urgent need for decisive action.

Until then, borrowers remain trapped in a cycle of debt, harassment, and hopelessness.

Add Comment