A customer of NCBA Bank in Kenya recently faced a troubling situation.

While working in Europe between July and September, he deposited over Ksh 400,000 into his NCBA account.

Upon returning to Kenya in October, he was shocked to find that his account balance was zero.

Additionally, he discovered that his account had been used to secure a loan of over Ksh 4,000 without his knowledge or consent.

When he contacted the bank for an explanation, they initiated an investigation but have yet to provide clear answers.

This experience has left the customer feeling frustrated and disheartened.

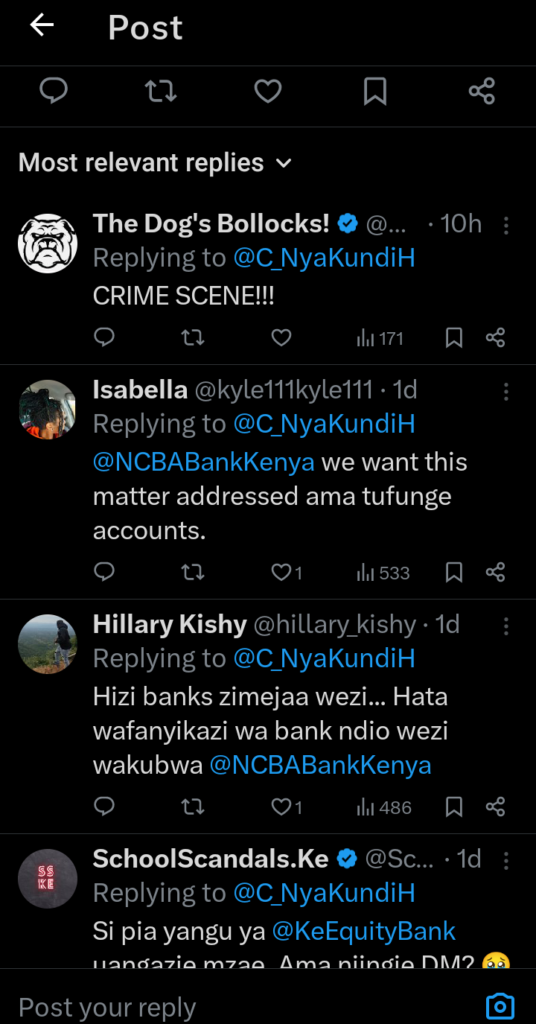

This incident is not isolated. Other NCBA customers have reported similar issues.

For example, a woman shared on social media that her funds went missing from her NCBA account.

After she raised the issue publicly, the bank eventually located her money.

In response to such complaints, NCBA Bank has outlined a procedure for handling customer grievances.

They encourage customers to report issues through various channels, including visiting branches, calling their customer contact center, sending emails, or reaching out via social media platforms.

The bank commits to acknowledging receipt of complaints promptly and aims to resolve them efficiently.

Despite these procedures, some customers feel that their concerns are not addressed promptly or transparently.

The lack of clear communication and delayed resolutions can erode trust between the bank and its clients.

For customers facing similar issues, it’s advisable to document all communications with the bank, including dates, times, and the names of bank representatives spoken to.

If the bank does not resolve the issue satisfactorily, customers can escalate the matter to the Central Bank of Kenya, which regulates financial institutions and oversees their adherence to banking laws and regulations.

This situation highlights the importance of vigilance in monitoring bank accounts regularly.

Customers should promptly review account statements and report any unauthorized transactions or discrepancies.

Additionally, safeguarding personal banking information is crucial to prevent unauthorized access or fraudulent activities.

While NCBA Bank has established procedures for handling customer complaints, the experiences of some customers suggest that there may be gaps in the effective resolution of issues.

It’s essential for the bank to address these concerns transparently and efficiently to maintain customer trust and confidence.

Customers, on their part, should remain proactive in monitoring their accounts and assertive in seeking resolutions when discrepancies arise.

Add Comment