According to a new audit report, the National Treasury cannot account for the Ksh160 billion spent on external debt payments over the last three fiscal years.

This comes as the government aims to borrow Ksh413 billion this fiscal year, according to Treasury CS John Mbadi.

A Special Audit Report on the Servicing of External Loans revealed concerns about budgeted corruption, potential plunder, and waste of public funds.

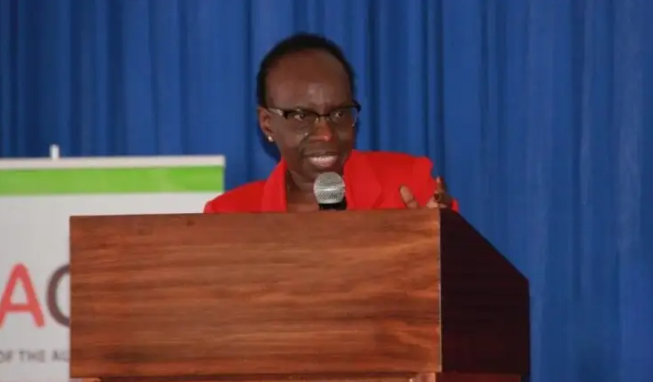

In the report, Auditor General Nancy Gathungu voiced worry about Ksh161 billion in unpaid debt over the last three fiscal years.

Gathungu informed the National Assembly’s Public Debt and Privatisation Claims Committee that there were inconsistencies between the budgeted and actual debt service amounts for the financial years 2020-2021, 2021-2022, and 2022-2023.

These variations surpassed the 5% limit set by law, reaching up to 10% of the approved sums for the fiscal year.

According to the research, the Treasury was underpaid by Ksh1.4 billion in 2021 and a whopping Ksh83.3 billion in 2022.

The Controller of the Budget has budgeted Ksh235.3 billion in 2021 and Ksh339 billion for 2022.In the following fiscal year, the Treasury exceeded the approved amount by Ksh77 billion.

The Controller of Budget had allocated Ksh311 billion for debt reservicing.

On Wednesday, November 27, MPs pressed the Treasury to explain the discrepancy discovered by the auditor general.

“This could be an issue of corruption…the procurement laws are very clear. You don’t procure services and goods beyond your budget,” stated Joseph Makilap, Baringo North MP.

In its response to the Auditor General, the Treasury defended the discrepancies, claiming that the swings were caused by the Kenyan shilling’s exchange rate against other currencies.In

her report, Auditor General Nancy Gathungu identified inadequacies in documentation that made it hard to track the borrowed monies for specific projects.

The audit evaluated 32 project loans and discovered that only 18 had undergone feasibility assessments to demonstrate their necessity.

Furthermore, 22 of these loans lacked paperwork or evidence of public participation, which resulted in projects being undertaken without significant citizen input.

The report also revealed that many of the loans did not acquire the necessary permits, putting the projects at risk of double financing and unbudgeted expenditures.

Very much concerning, only five of the 32 loans had received legal opinions from the Attorney General, raising severe questions about the borrowed money’s legal and procedural compliance.

Add Comment