A customer’s trust in a bank can sometimes be tested not by big financial losses but by the small frustrations that happen during everyday transactions.

Many people today rely on mobile apps to pay bills, send money, or even check balances while on the move. It saves time and makes life easier, but when the app fails, the consequences can be more than just an inconvenience.

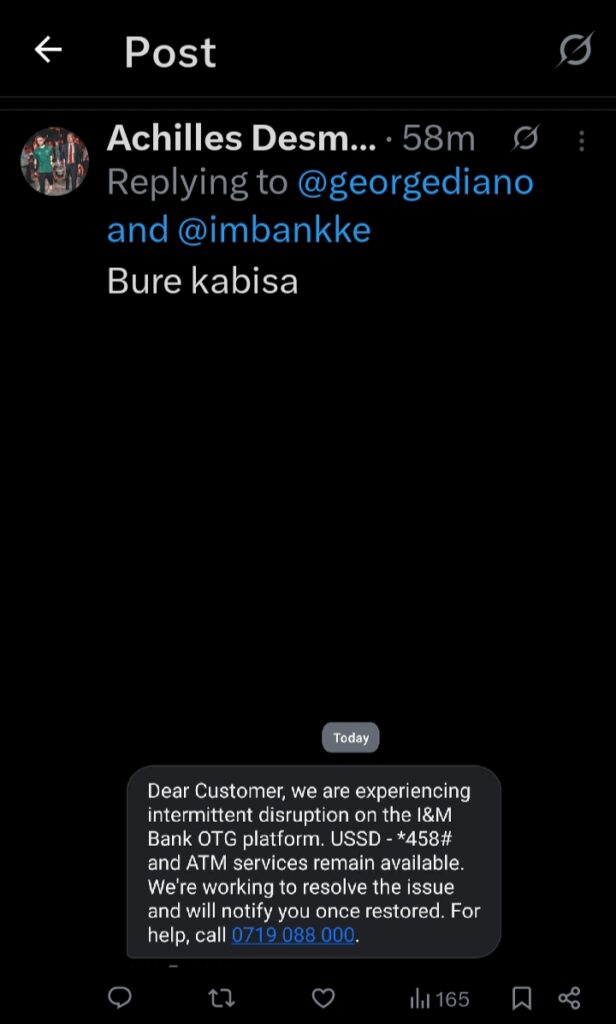

An X user George T. Diano expressed his frustration with I&M Bank’s mobile app, saying it had embarrassed him three times in public because it was always under maintenance. He accused the bank of putting more energy into online public relations than actually fixing its services, and his post quickly attracted attention because it echoed what many customers feel when systems fail at the wrong time.

Mobile banking has become part of daily life in Kenya, with millions of people depending on it for fast and secure transactions.

This reliance makes any failure a serious issue. It is normal for banks to carry out maintenance to improve security or add new features, but when disruptions happen too often or without clear communication, customers feel stranded.

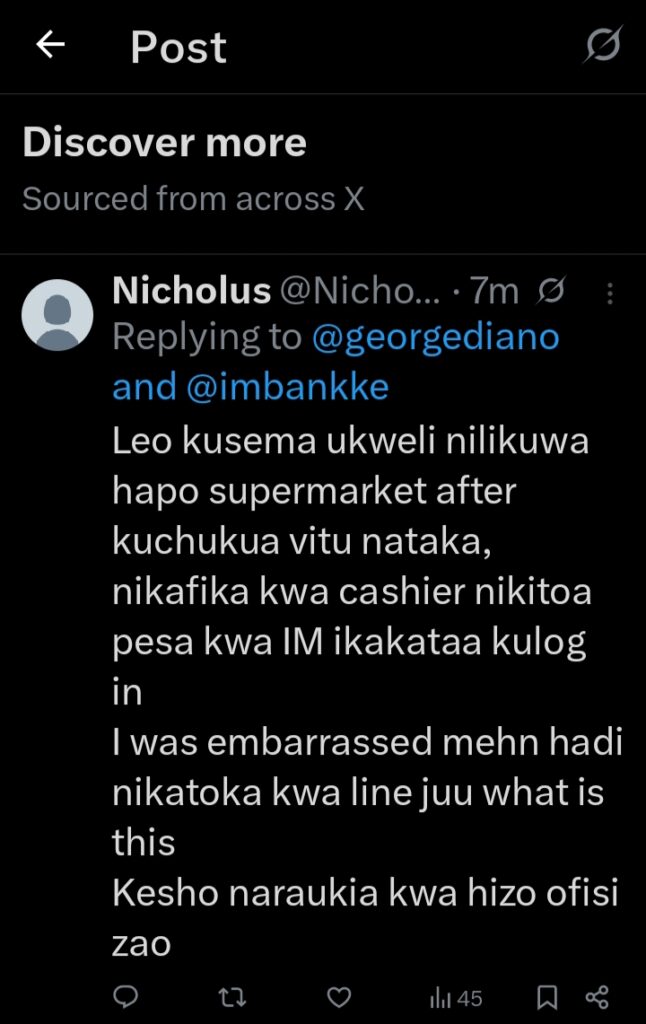

Imagine being at a supermarket counter ready to pay, or boarding a bus and trying to complete a transaction, only to be told the app is not working.

That kind of disruption can be embarrassing, frustrating, and costly.

Scrolling through conversations on X shows George is not alone. Several other customers have shared similar complaints about I&M Bank’s app. One said downtimes had become so regular almost every two business days that the service felt unreliable. Another mentioned being stranded with unpaid bills twice in just a few weeks.

Some even shared lighthearted jokes about the app being the “winner” of the most frustrating app of the week, though beneath the humor was clear disappointment.

Traders depending on the app for daily business transactions complained about losing work time and money because of sudden outages. Others pointed out that business accounts were especially affected, with apps crashing or failing to load properly when needed most.

In fairness, I&M Bank has not ignored the issue. The bank has publicly apologized in some cases and assured customers that technical teams are working on improvements.

They often highlight their financial growth and new customer sign-ups as proof of progress, but the frequent outages risk undoing those gains by frustrating loyal clients.

Even customers living abroad have added their voices, saying the app’s failures affect them too, which shows how wide-reaching the problem can be.

Some users have suggested solutions such as diversifying accounts across multiple banks like Coop or KCB so that one outage does not completely disrupt daily life.

Others encouraged I&M to put less focus on digital image building and more on practical, consistent service delivery. This advice highlights an important truth: in digital banking, reliability is just as important as innovation.

The lesson from these stories is that mobile banking is now central to modern life, and any disruption has a ripple effect on business, family, and social interactions. While no bank is perfect, customers expect open communication, timely fixes, and genuine effort to reduce interruptions.

For users, it may help to stay informed about scheduled maintenance or keep backup payment options available. For banks, listening to customer feedback and acting on it quickly can make the difference between trust and frustration.

The situation with I&M Bank is a reminder that technology, while powerful, must be backed with reliability.

Add Comment