Kenya’s decision to give Auditor General Nancy Gathungu real-time access to a new digital debt registry is seen as a step toward improving transparency in how the country manages its public debt. This move comes at a time when the country is dealing with a growing debt crisis.

By June 2024, Kenya’s total debt had reached Ksh 10.6 trillion, which is 70 percent of the country’s GDP. This rising debt has raised serious concerns about how the government is managing its finances, especially with fears of more taxes and reduced spending on vital services like health and education.

On June 14, 2025, the Auditor General was granted access to a digital registry that gives real-time data on all debt-related transactions. The system is connected to the Commonwealth Meridian Debt Management System, IFMIS, and the Central Bank of Kenya, allowing instant visibility into how much money Kenya is borrowing and repaying.

This digital tool is expected to help in tracking public debt better and making sure borrowed money is used wisely. Treasury Cabinet Secretary John Mbadi said the aim is to improve efficiency and ensure transparency in managing public debt.

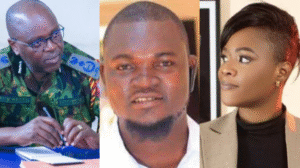

Nancy Gathungu, who was appointed Auditor General in July 2020, is known for her experience in public audits. With over 27 years in the field, her role is to ensure government money is used properly and to report any misuse.

By getting real-time access to the debt data, she can now monitor loans and repayments as they happen, which may help identify mismanagement early and take action faster.

However, not everyone believes this move will bring real change. Many Kenyans on social media, especially on X, gave mixed reactions. Some welcomed the move as a good step, while others were doubtful. One user said the move just allows the Auditor General to watch the problem unfold without actually stopping it.

Another user asked who will be held accountable for borrowing and stealing public money, suggesting that tracking alone is not enough. People want answers on who borrowed the money, how it was spent, and who should face punishment if there was corruption.

The public’s frustration is understandable, especially considering that a large part of the debt is due for repayment soon. The 2025 Medium Term Debt Management Strategy shows that 18.6 percent of domestic debt will mature by June 2025, with even more repayments due in the years after.

Much of this debt includes short-term Treasury bills and commercial loans that carry high interest rates. If not managed well, these repayments could put even more pressure on the country’s already strained budget.

Despite these concerns, the digital registry does have potential benefits. It could help the Auditor General detect suspicious borrowing patterns and raise red flags before things get worse. It also matches global best practices, where countries use technology to improve how they manage debt.

Giving the Auditor General real-time access to debt data is a good idea on paper. But for it to work, the government must follow it up with real action.

Add Comment