Kileleshwa MCA Robert Alai has shaken both financial and political circles with his strong criticism of Equity Bank’s rise and the challenges it now faces.

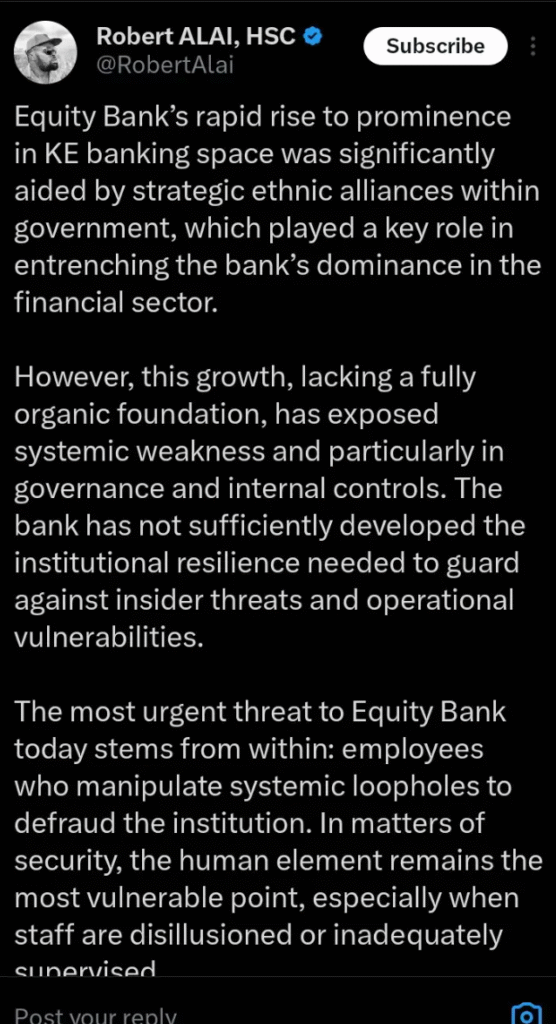

According to Alai, Equity Bank’s quick climb to become one of Kenya’s leading financial institutions was not just because of smart business moves or innovation. Instead, he claims that the bank’s success was heavily influenced by close political connections, especially through ethnic ties within the government.

These ties, Alai argues, gave Equity Bank an unfair advantage over its competitors.Alai’s words bring attention to a reality that many people have quietly talked about for years. While the bank has shown fast growth and expansion, there are doubts about how solid its foundation really is.

This is not just about politics or dominating the market. The bigger problem lies in what is happening inside the bank itself. He points out that the most serious risk facing Equity Bank today is from within the institution. There are reports that many staff members are exploiting weak internal controls to commit fraud.

This situation is more than just a security issue, it shows there are bigger problems with how the bank is managed and supervised. These internal weaknesses put the bank’s money and reputation in danger.

Because of these problems, Alai is calling for a thorough internal audit of Equity Bank. He believes this is the only way to find and fix all weak points inside the bank. This move is necessary to protect customers’ deposits and bring back full public confidence in the bank.

If the bank fails to act quickly and strongly, Alai warns, its reputation and overall stability could suffer serious damage. The comments by Alai have caused heated discussions on social media and in financial circles.

Many people are now wondering how deep these problems go and if other major banks might also have similar weaknesses. This situation puts Equity Bank under intense pressure, and everyone is watching closely to see what happens next.

Equity Bank, once seen as a shining example of growth and success in Kenya’s banking sector, now faces a harsh spotlight. The accusations about political interference and internal fraud threaten to undo years of progress. The bank’s ability to handle these issues will be tested in the coming months, and how it responds could shape its future.

The call for transparency and stronger governance is clear. Equity Bank must act decisively to prove it can protect its customers and operate fairly without relying on political favors or turning a blind eye to internal corruption.

Add Comment