In a report shared by Tom Mukhwana on Kenya’s energy sector development, a concerning pattern of potential conflicts of interest and questionable dealings has emerged regarding the establishment of power plants in the early 2000s. The investigation reveals how a company with no prior experience in electricity generation managed to secure a lucrative government contract worth millions of dollars.

Kenya faced rising electricity demands in the early 2000s, prompting intervention from the World Bank to oversee tendering for four power plants meant to boost the nation’s electricity generation capacity. These included one geothermal plant and three diesel-powered facilities, among them Triumph Power Generating Company.

The combined projects represented an investment of $623 million, with financing coming from commercial banks and various World Bank financial instruments.

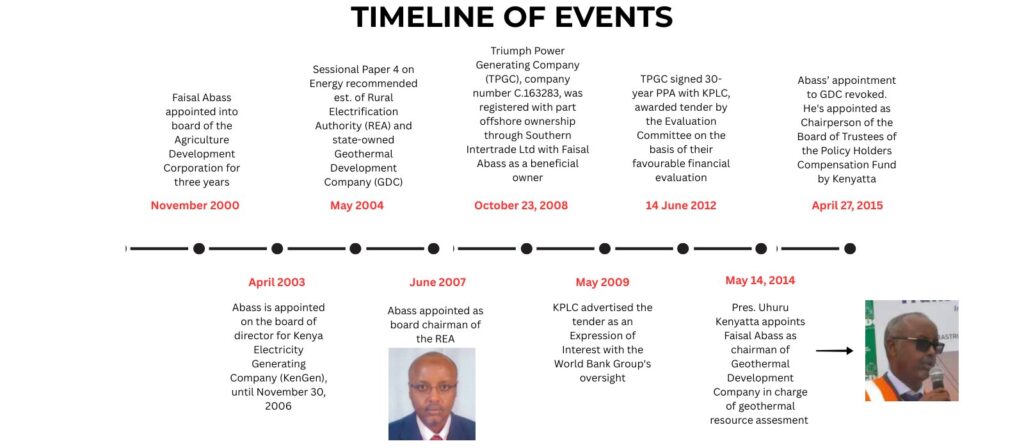

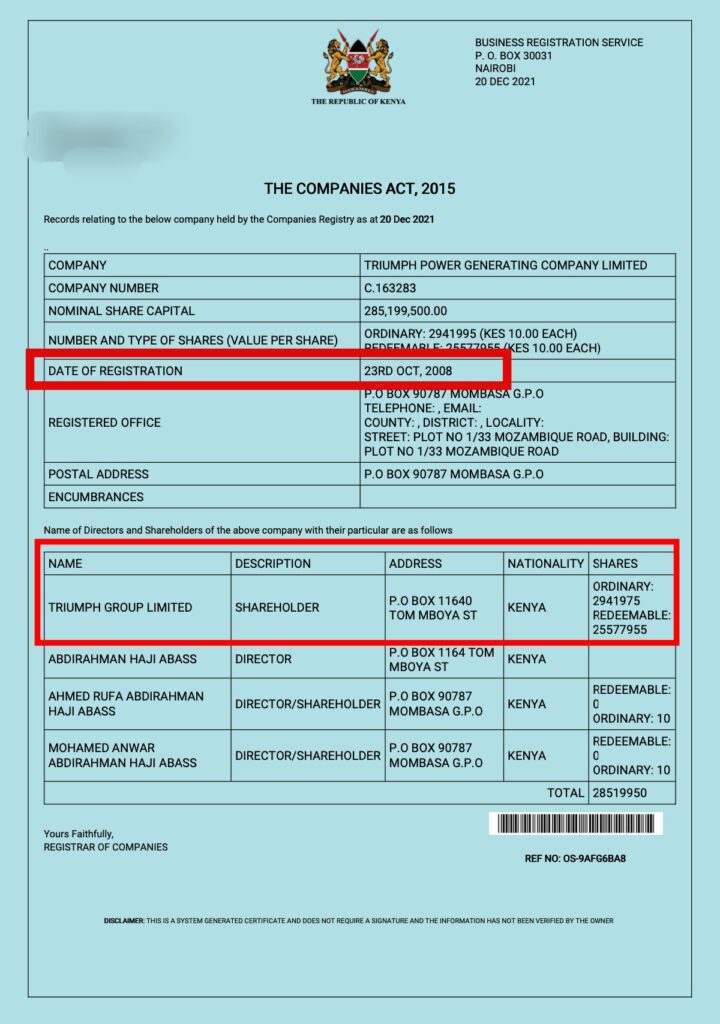

The questionable circumstances began when Kenya Power and Lighting Company (KPLC) advertised an Expression of Interest for an Athi River plant on May 29, 2009. The winning bidder, Triumph Power Generating Company, had been registered just seven months earlier in October 2008 and had no previous experience in electricity generation anywhere in the world.

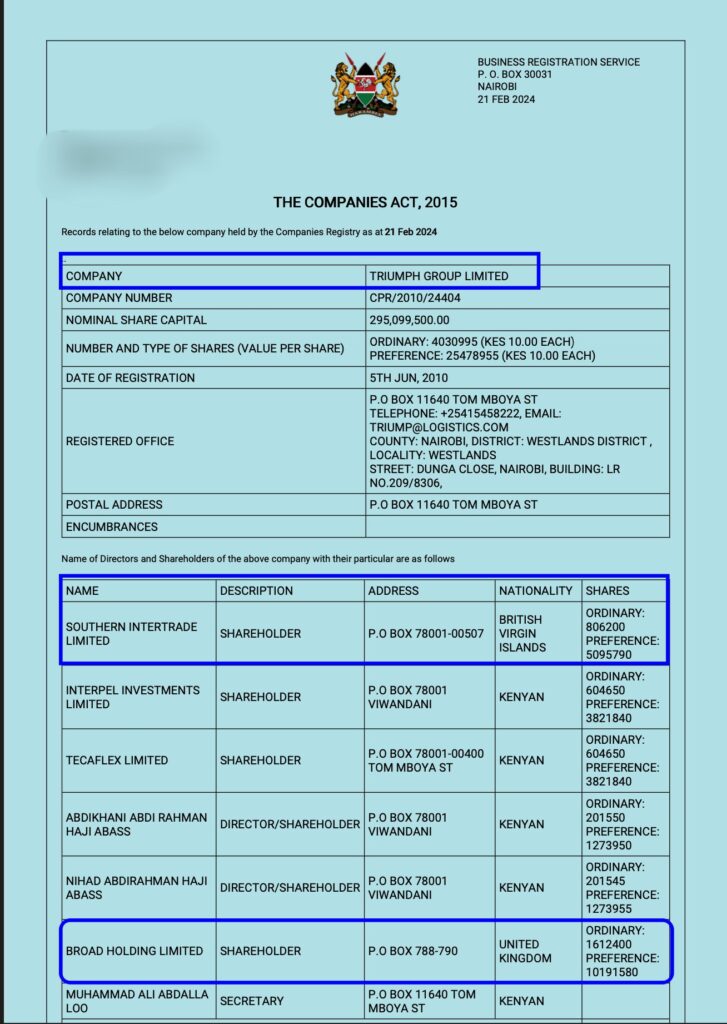

Further investigation into Triumph’s structure revealed that its shareholding was primarily concentrated within one family. However, it also included a shell company called Southern Intertrade, which was registered in the British Virgin Islands a jurisdiction well-known as a secrecy haven for business dealings.

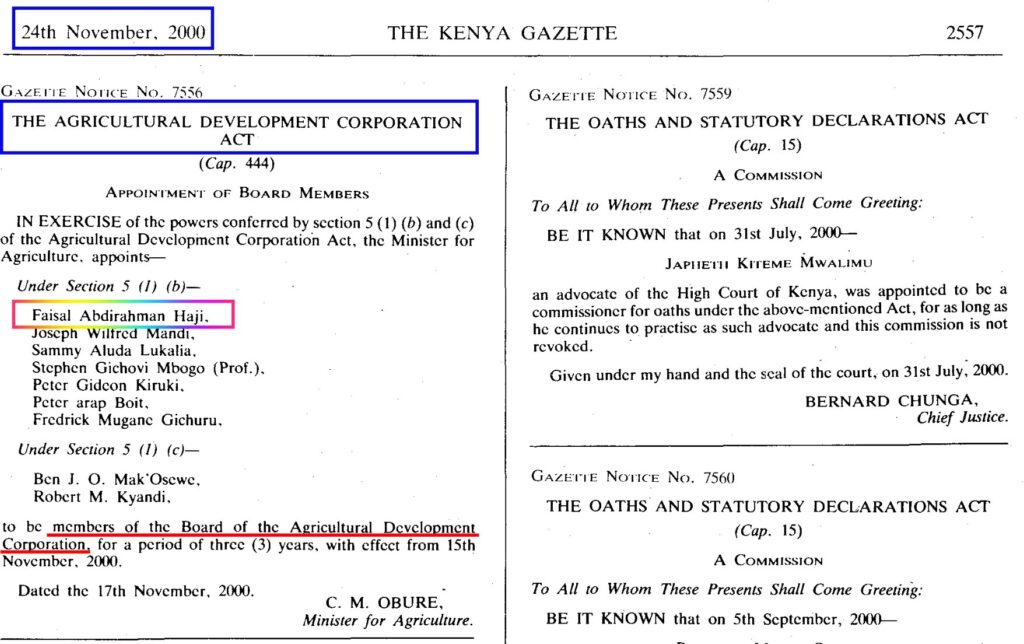

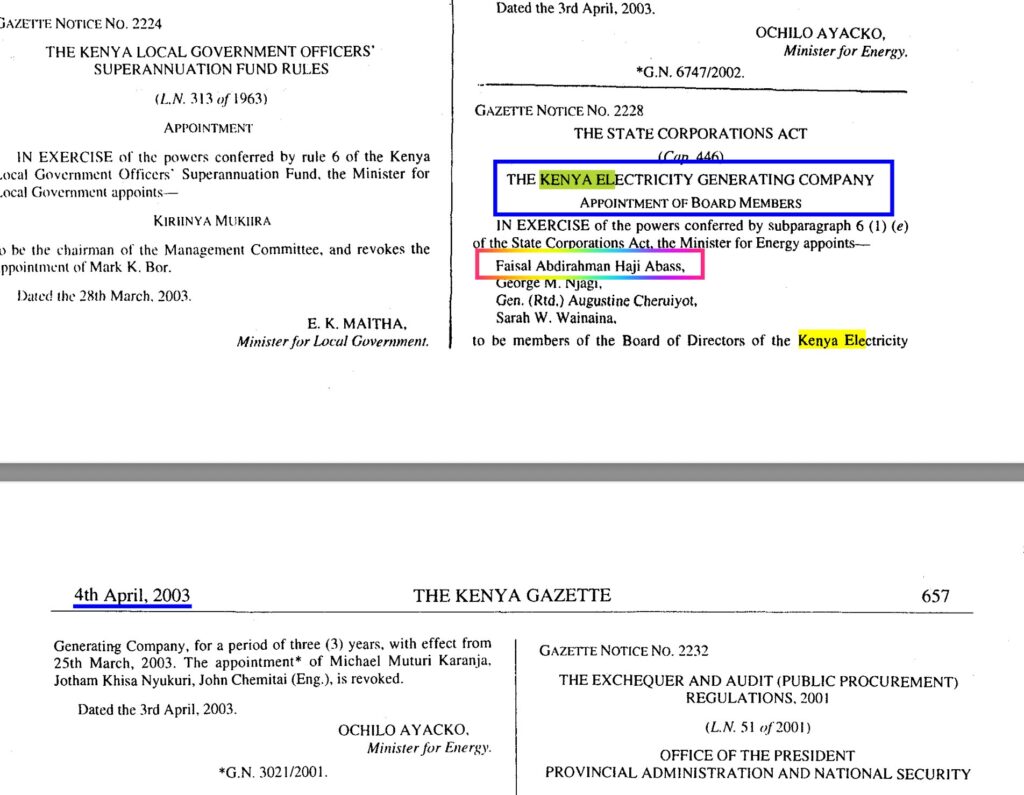

The beneficial owner of this offshore entity was listed as Faisal Abdirahman Abass. Abass’s connections to Kenyan governmental bodies began years earlier. His first government appointment came in 2000 when he joined the board of the Agriculture Development Corporation.

This was followed by an appointment to the board of directors at KenGen in April 2003, where he served until November 2006. By June 2007, Abass had secured the position of board chairman at the newly formed Rural Electrification Authority (REA).

It was during his tenure at REA that Triumph a company he apparently had concealed ownership in successfully won the tender to develop an 83-megawatt diesel plant in Athi River’s Export Processing Zone. This project was estimated to generate over 23.3 billion Kenyan shillings in dividends.

The connections between government positions and private business interests continued when in 2015, then-President Uhuru Kenyatta appointed Abass as chairman of the Geothermal Development Corporation.

This created a striking contradiction, Abass was publicly leading Kenya’s push toward renewable energy while simultaneously profiting from a diesel energy plant through his family’s interests.

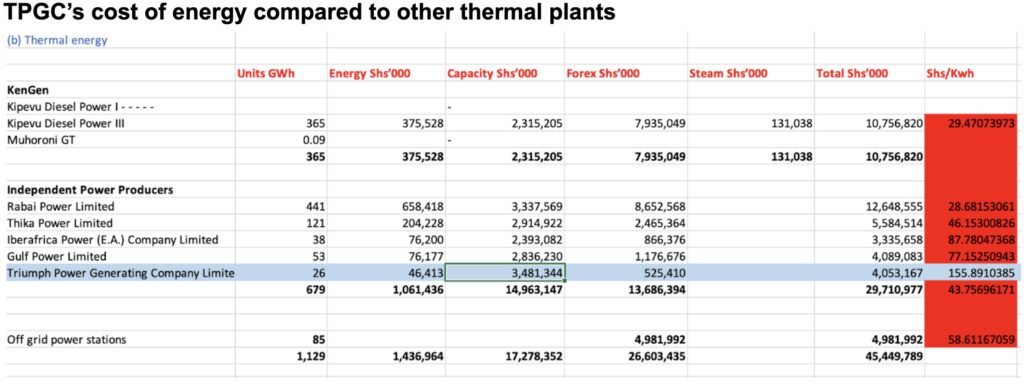

The financial implications for Kenyan consumers have been dire. According to World Bank documentation, Triumph was contracted to sell one kilowatt-hour of energy at 29.90 Kenyan shillings (approximately $0.23). The contracts included provisions like “Take or Pay” clauses that make diesel Independent Power Producer plants particularly expensive, as consumers end up paying for capacity even when it isn’t used.

By the 2023/2024 period, Triumph’s cost was nearly 2.5 times higher than other diesel IPPs operating in the country. This case shows the complex challenges facing Kenya’s energy sector, where personal connections and business interests may interfere with the development of affordable and sustainable power solutions for the country’s growing population and economy.

Add Comment