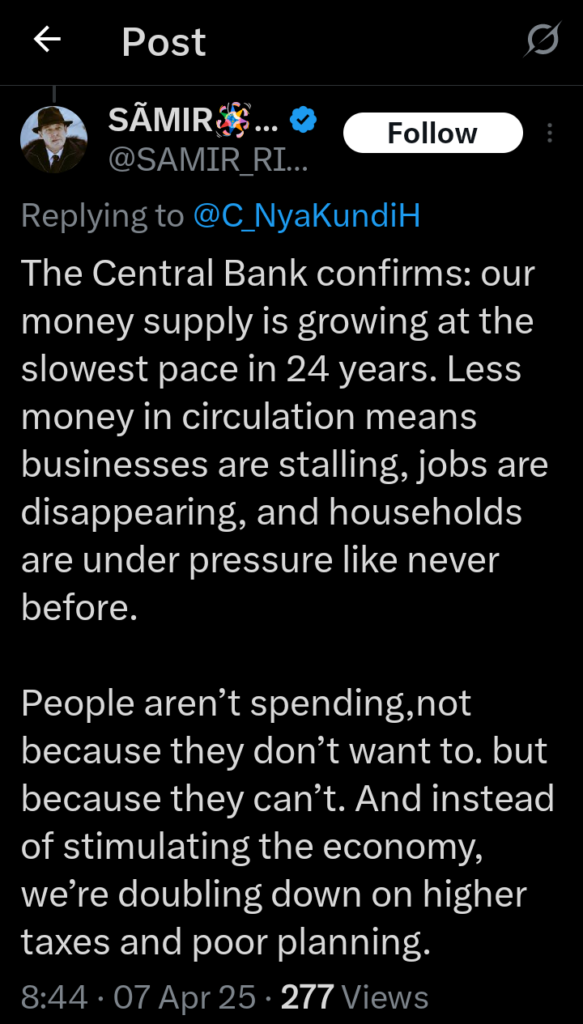

Kenya’s economy is facing serious trouble, and the latest data from the Central Bank of Kenya (CBK) shows just how bad things have become. According to CBK, the country’s money supply is growing at the slowest rate in 24 years.

This means there is less money moving around in the economy. When money supply is low, it shows that people are not spending as much as they used to. That directly affects businesses, workers, and even government projects. Everyone ends up feeling the pressure in one way or another.

When people don’t have enough money in their pockets, they stop buying goods and services. This leads to lower sales for businesses. A business that isn’t making money can’t afford to pay workers well, and in some cases, they are forced to lay off staff or close down. Small businesses, which form the backbone of Kenya’s economy, are usually the hardest hit.

With customers disappearing, many small shops and kiosks are now struggling just to survive. Some are cutting down on their operations while others are being pushed out completely. This creates a dangerous cycle of job losses and reduced economic activity.

The slow growth in money supply also affects borrowing. When money is tight, banks tend to raise interest rates or become more cautious in giving out loans. That makes it even harder for individuals or businesses to access funds for investment or expansion. Without loans, farmers can’t afford fertilizer, traders can’t restock, and companies can’t upgrade equipment or hire more staff.

The result is economic stagnation, where nothing seems to be moving forward. The situation is not helped by rising taxes and high cost of living. With the government collecting more taxes while offering little relief, Kenyans are being stretched beyond their limits. High prices for food, fuel, and basic items mean that even those with jobs are cutting back on spending.

The ripple effect is that demand continues to drop, and businesses have no choice but to downsize or shut down. Worse still, the government’s debt burden is limiting its ability to spend and stimulate the economy.

Instead of using money to create jobs or improve infrastructure, a big portion of national revenue is going towards paying off loans and mismanagement. That means there’s less support for sectors that could help revive growth, such as agriculture, manufacturing, and education.

Overall, the slow money supply growth is a strong sign that Kenya’s economy is under deep stress. If the government doesn’t take serious steps to inject life into the economy, things are likely to get worse.

What we are seeing now is not just a temporary slowdown it’s a warning that something is fundamentally wrong with how money is circulating in the country. People are broke, businesses are hurting, and the squeeze is being felt in every corner of the economy.

Add Comment