Equity Bank is once again under intense public criticism after a series of disturbing reports from customers who claim to have lost money through unauthorized transactions.

The growing number of such incidents has raised serious questions about the bank’s reliability, transparency, and commitment to protecting its customers’ funds.

Many Kenyans now believe that the institution has grown too comfortable in its dominance, neglecting the very people who built its reputation.

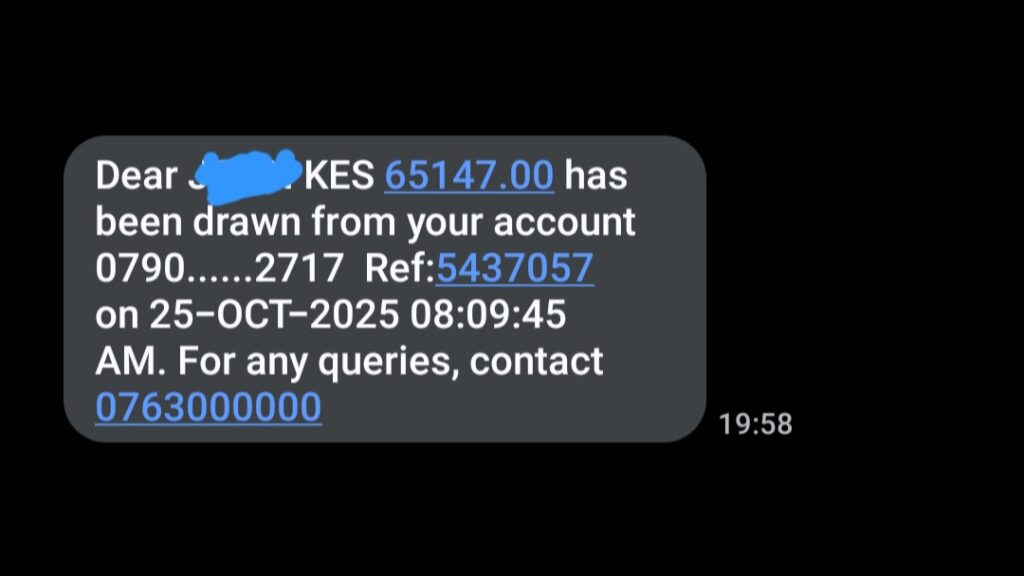

One of the most alarming cases involved a customer who woke up to find that KSh 65,147 had mysteriously disappeared from their account.

According to the user, the withdrawal happened on October 25, 2025, without any prior authorization. The person tried calling Equity’s customer service several times before the money was finally refunded later that evening around 8 p.m.

While the refund came as a relief, the customer’s frustration was clear. They expressed deep concern about how such a breach could occur and vowed to visit the bank’s branch the next day.

For many Kenyans, this story symbolized a growing fear that their money is no longer safe with Equity Bank.

What makes the situation worse is that this was not an isolated case. Several other users on social media have come forward with similar complaints, claiming to have lost money under questionable circumstances.

One of the most shocking reports came from a Kenyan woman living in the United States who allegedly lost 1.6 million shillings from her Equity account.

She shared her ordeal online, wondering how such a massive amount could vanish without detection. These repeated complaints suggest either a major security loophole or a worrying level of negligence within the bank’s systems.

Customers have also been complaining about hidden charges and unnecessary deductions that chip away at their savings.

A small depositor narrated how they had put in KSh 250 to start saving, only to find it gone the next day because of a debit card fee they never requested.

Others have accused the bank of exploiting customers through costly SMS alerts and transaction fees that add up over time. For a bank that markets itself as the champion of ordinary Kenyans, these charges feel more like exploitation than service.

The situation worsens when system failures strike. Customers have shared cases where transactions to mobile wallets like M-Pesa failed due to technical problems, yet Equity still charged fees for incomplete transfers.

Many said they had to take their frustrations to social media to get attention from the bank. Equity’s responses often include apologies for “service disruptions,” but the pattern of repeated failures shows deeper issues that have not been fixed.

Delays in resolving these problems have only made things worse. Some affected clients have even proposed protests at Equity’s headquarters, accusing the bank of ignoring complaints and moving slowly when it comes to refunds or transaction disputes. International remittances taking days to reflect in accounts have also become a major concern, especially for families relying on that money for urgent needs.

While Equity continues to post reminders online about cybersecurity awareness, customers say such messages sound empty when internal weaknesses remain unchecked.

Instead of shifting the blame to customers, the bank needs to strengthen its internal controls, improve transparency, and rebuild confidence through swift and fair responses to complaints.

Equity Bank’s current troubles reflect a deeper crisis of accountability in Kenya’s banking sector. The institution’s success was built on trust and accessibility, but that trust is now being tested.

If the management fails to address these growing frustrations, more customers may choose to leave for banks that value security and integrity.

For an institution once hailed as a pillar of financial inclusion, Equity now faces a defining moment either act decisively to restore confidence or watch its credibility crumble under the weight of public anger.

Add Comment