Many Kenyans are growing tired of the way M-Pesa has turned from a celebrated innovation into a financial burden that punishes its most loyal users.

What started in 2007 as a tool to help the unbanked has now become a system weighed down by endless charges that eat into the little money people are struggling to save and use.

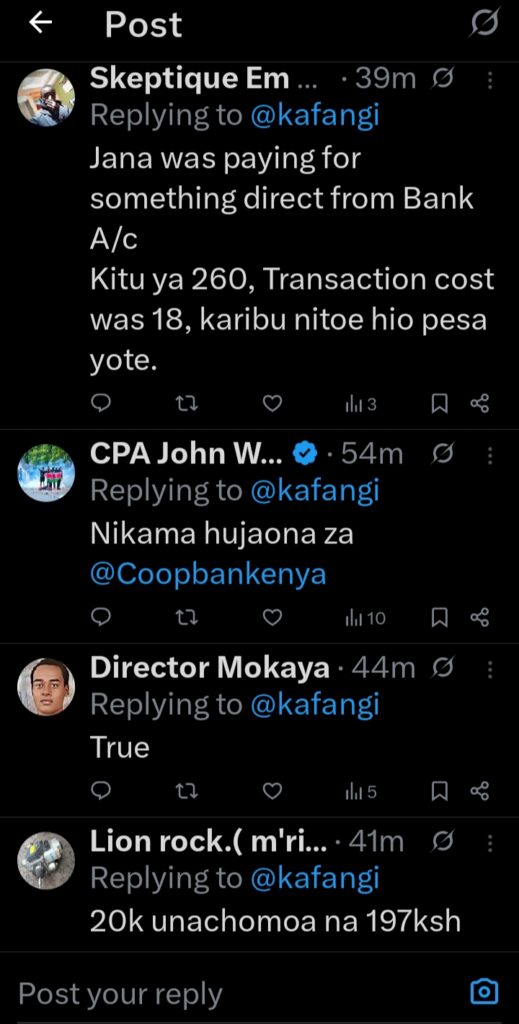

Ordinary citizens express this frustration daily, with one simple statement capturing the mood on the ground: “Transactions cost za mpesa ziko juu tu sana.”

The truth is clear when you look at the numbers. Withdrawing small amounts like 105 shillings can attract charges as high as 27 percent, which is almost robbery when you think about the fact that these are usually low-income users trying to get by with the little they have.

In 2023, excise duty on mobile money fees went up from 12 to 15 percent, and instead of absorbing some of this cost, Safaricom simply pushed it back to the customers by hiking charges further.

By 2025, sending just 2,500 shillings costs 79 shillings, while withdrawing 1,000 shillings from an agent takes 29 shillings, which is more than double the fee it costs to send. These charges make it nearly impossible for the poor to keep up.

For small businesses, things are even tougher. Merchants using Lipa na M-Pesa face a 1 to 2 percent cut on every payment, and since many businesses run on thin profit margins, these costs are pushed back to customers.

A simple purchase becomes more expensive because the fees are quietly added to the final cost. This has left many business owners and customers feeling cornered.

Stories of users losing large sums to transaction fees are everywhere, including one person who was shocked to find 53 shillings cut from a 3,400 shilling transfer.

The monopoly that Safaricom enjoys has only made things worse. In 2025, regulators are scrutinizing M-Pesa over antitrust issues, with many pointing to the Ziidi service, which has zero fees, as proof that Safaricom plays favorites to protect its market grip while ignoring the plight of everyday users.

On social media, Kenyans are increasingly encouraging one another to abandon M-Pesa for cheaper alternatives, like bank-to-M-Pesa free transfers offered by I&M Bank. But with 34 million users tied to the platform, the shift is difficult, and Safaricom knows it, choosing to continue collecting billions in revenue instead of making services affordable.

The sad reality is that financial inclusion, which M-Pesa once promised, is now being undermined by its own charges. The poor are paying more, not less, relative to what they transact. In a country where economic pressures are squeezing families and every coin matters, losing big chunks to charges feels like exploitation.

Unless regulation steps in to cap fees and force real competition, M-Pesa risks going down in history not just as a revolutionary tool but also as a system that trapped its own people in endless costs while pretending to empower them.

Add Comment