Anthony Mwaura, the former chairman of the Kenya Revenue Authority, has surprised many Kenyans by making a huge investment in HF Group. Together with his wife and daughter, the family reportedly bought a 12.7 percent stake in the financial company, worth around Sh1.6 billion.

This investment makes them the second-largest shareholders after Britam.

According to details published by Business Daily and confirmed by an X post from Moe, Mwaura invested Sh548 million, his wife Sh533 million, and their daughter Sh528 million. These figures have raised many questions, especially from the public, about how the family managed to raise such a large amount of money in a short time.

HF Group is a well-known financial institution in Kenya, offering services in mortgage lending, banking, and property development. It was started in 1965 and is listed on the Nairobi Stock Exchange.

The company has recently been trying to improve its performance and recorded a 46 percent growth in profit last year. The Mwaura family’s investment could help the company grow even more, but it has also attracted attention for the wrong reasons.

Many Kenyans are suspicious of the source of the money used in the deal. Some believe it could be linked to Mwaura’s past while he was in public service.

Anthony Mwaura was appointed KRA chairman in November 2022, a position that came with a lot of responsibility in collecting taxes and fighting tax evasion. However, his time in office was not without controversy.

He was taken to court in connection to a Sh357 million embezzlement case involving the Nairobi County Government and former Governor Mike Sonko. In February 2024, he was acquitted of all charges.

Later that year in December, he was moved to head the Kenya Rural Roads Authority, and Ndiritu Muriithi took over as the new KRA chairman. This shift from public office may have opened the door for him to begin investing in private companies like HF Group.

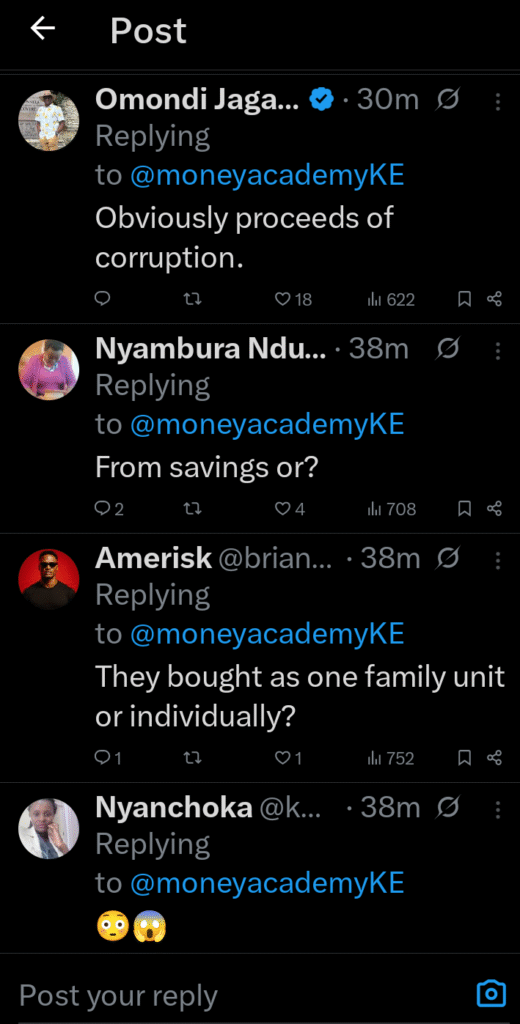

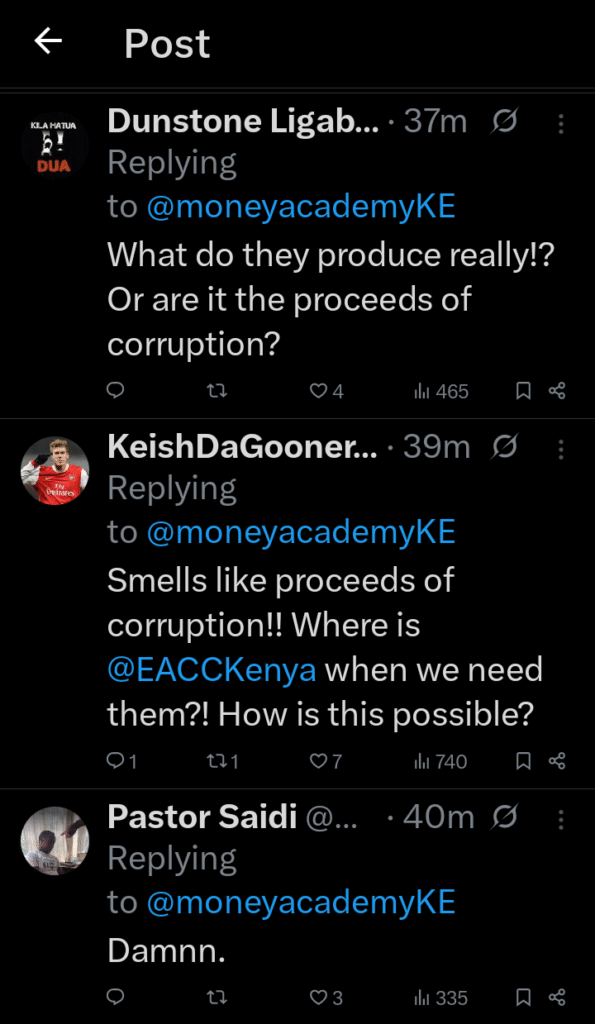

Despite being cleared by the courts, Mwaura’s large investment has not escaped public scrutiny. Many Kenyans on social media, especially on X, have openly questioned where the money came from.

The fact that his daughter, who is not known to hold any major business position, could afford Sh528 million has been one of the most debated issues. Some users have called for the Ethics and Anti-Corruption Commission to investigate the source of the funds, even though no new evidence of corruption has been presented.

The suspicion mainly comes from the belief that public officials in Kenya often leave office richer than they should be, and people are demanding more transparency.

For now, the investment appears to be legal. Mwaura was found not guilty in court, and there are no official restrictions stopping him or his family from investing in the private sector. But the debate surrounding this move shows that Kenyans are growing more alert and curious about how former public officers acquire their wealth.

Despite HF Group benefiting from this new injection of capital, questions about integrity, fairness, and accountability continue to hang in the air.

Add Comment