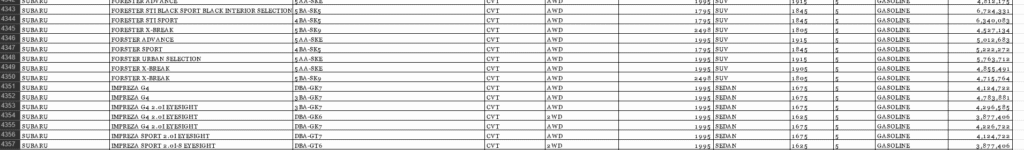

The Kenya Revenue Authority (KRA) has rolled out a new Current Retail Selling Price (CRSP) schedule for taxing imported used cars starting July 1, 2025. This new approach is meant to make taxes fairer by using the actual price of the car instead of the previous fixed prices.

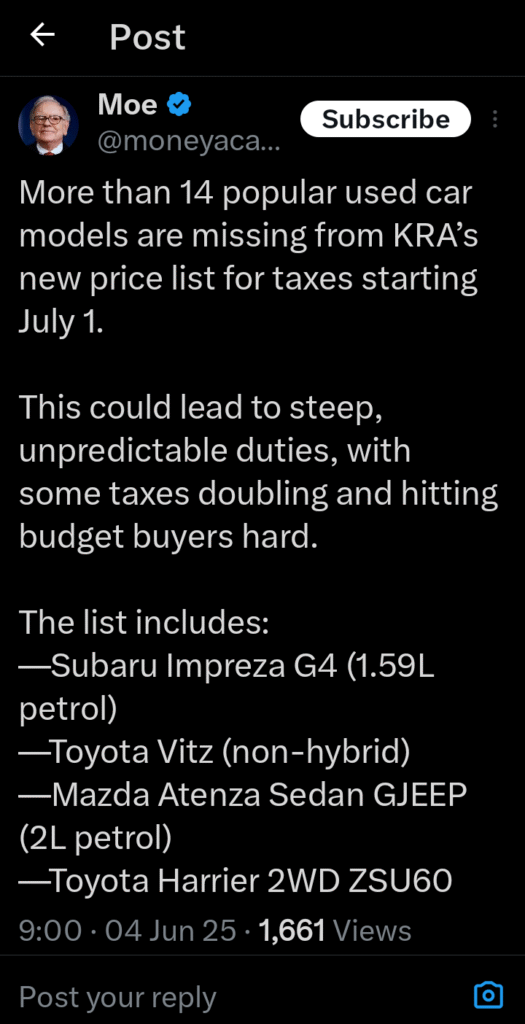

However, many Kenyans are worried because over 14 popular used car models, such as the Subaru Impreza G4 and Toyota Vitz, are missing from the new list. Without clear price guides, taxes on these cars may become unpredictable and even double in some cases, hitting budget-conscious buyers the hardest.

These changes are likely to affect young people, small business owners, and ride-hailing drivers who depend on affordable second-hand vehicles to earn a living or get around. Models like the Mazda Atenza and Toyota Harrier, which are commonly imported into Kenya, are not listed in the new CRSP.

This has raised fears that KRA might use unofficial or inconsistent data to calculate taxes, which can lead to confusion and unexpected costs during the import process.

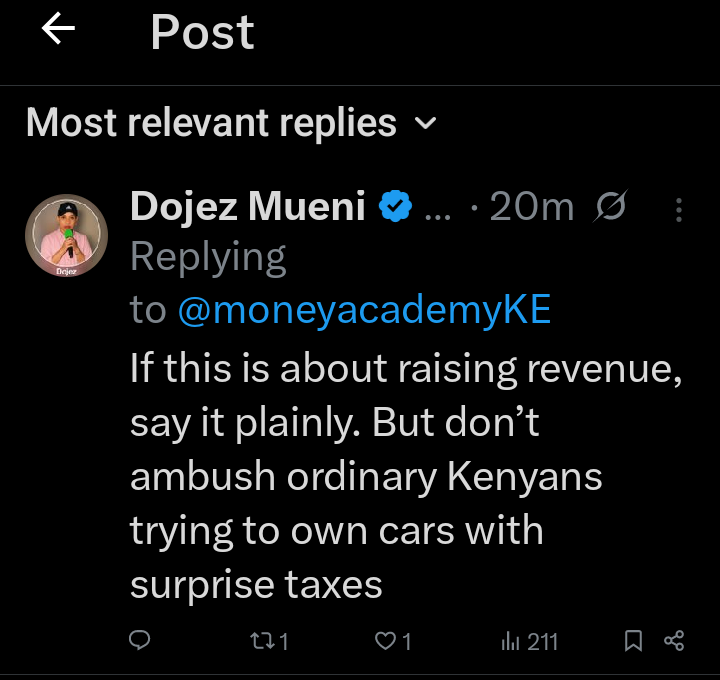

On social media, Kenyans have been voicing their frustration. Many people feel the new list ignores the reality of the local market. A user on X asked, “How do you leave out the very cars Kenyans import most?” while others called the move unfair and disconnected from what ordinary people need.

One user commented that the changes feel like a trick to raise taxes quietly without clear communication. These reactions reflect a growing sense of mistrust in how the new system will be implemented.

Despite KRA’s aim to make the tax system fairer, the omission of popular models could make things worse for many Kenyans. When car taxes go up suddenly, it affects people’s ability to afford transport. This not only makes life harder for individuals but could also slow down small businesses that depend on mobility.

With the cost of living already high, this new system could add another financial burden on the average citizen. KRA has encouraged importers to check the updated list on its website and stay informed, but until the missing car models are added or explained, the fear of surprise taxes remains.

Many are now calling for KRA to revise the list quickly and include the commonly imported models to avoid confusion and protect low-income buyers from being overcharged. Without clear action, the public will continue to feel targeted by a policy that was supposed to offer fairness but is now causing worry and frustration among those who can least afford it.

Add Comment