A serious tax scam is going on in Kenya where stolen ID cards and KRA PINs are being used to register fake companies. These companies are then used to avoid paying taxes and to clean dirty money.

The scam mainly targets innocent people, including domestic workers and travelers, who don’t even know their details have been used. Research shows that hundreds of Kenyans have already been affected.

Some are finding themselves in trouble with the law and being asked to pay millions in tax for businesses they never registered or operated.

One shocking case involves a Safaricom employee who was slapped with a Sh45 million tax bill. She says she doesn’t know anything about the company linked to her name. In another case, a Chinese national was sentenced to four years in prison for Sh74 million in unpaid taxes tied to a fake company registered using his details.

There’s also the case of a house help whose employer used her PIN to import second-hand clothes worth Sh349 million, avoiding Sh68 million in taxes. Many of these victims are helpless because they can’t prove their identity was stolen, and the system doesn’t protect them.

The Kenya Revenue Authority has started taking action. They are now doing forensic audits, placing travel bans on suspects, and checking immigration records. KRA is also looking into using biometric data and two-step verification to make it harder for fraudsters to register fake companies.

The process of verifying company directors is weak, and different government agencies are not sharing data properly. This gives scammers room to operate without being noticed for a long time.

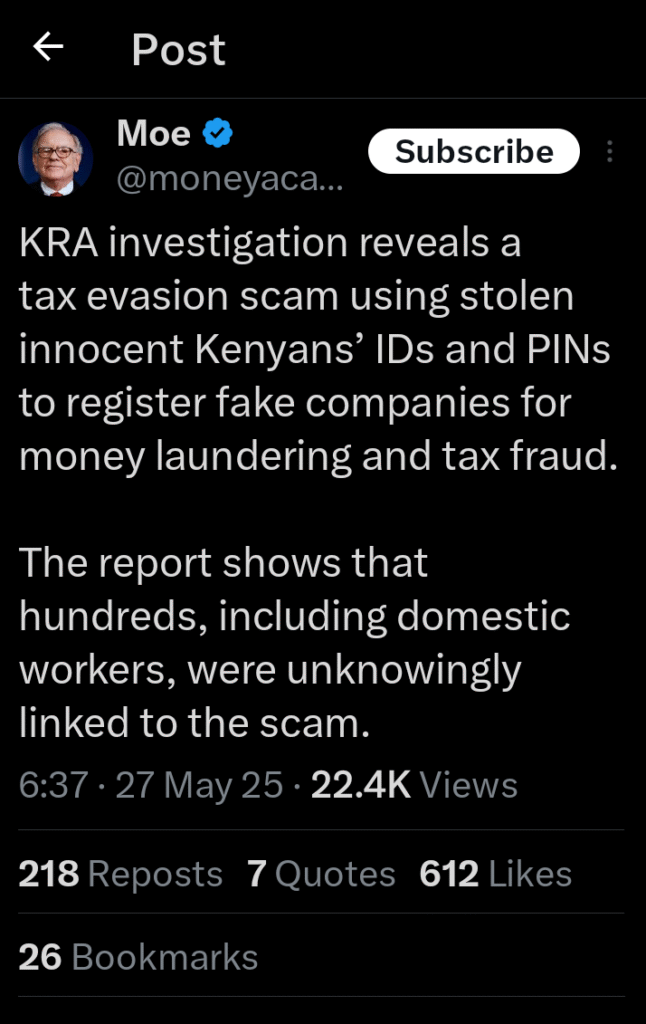

According to Moe on X, who posted about this issue, his post has drawn a lot of attention online, with Kenyans reacting in shock. Some people are advising others to regularly check their eCitizen accounts and credit ratings to catch any suspicious activity early.

Others are blaming the government for being careless and allowing such fraud to happen. There’s growing anger and frustration as more victims come forward.

KRA is also facing pressure from industry experts to act faster. Groups like the Fintech Association of Kenya are asking companies to improve their customer verification processes and protect their staff PINs.

Add Comment