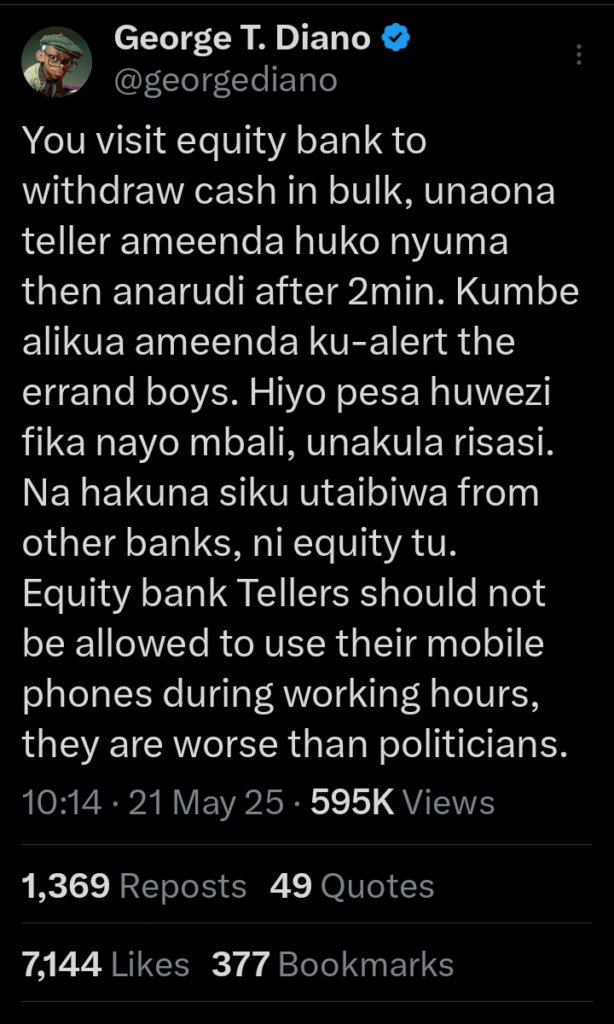

Security concerns at Equity Bank have sparked a public debate after an X post by George Diano alleged that some tellers might be alerting robbers when customers withdraw large amounts of money. The claim quickly caught attention online, with many Kenyans responding by sharing their own experiences and suspicions.

The post triggered widespread discussion, especially about how safe it is to withdraw cash from banks in Kenya. Equity Bank responded to the viral post by asking the user to share their contact details so they could follow up on the matter. They also pointed the public to a whistleblower portal where people can report such incidents.

Bank robberies in Kenya are not a new issue. Several cases over the years have shown that internal fraud and staff involvement can be a problem across the banking industry.

In 2015, robbers pretending to be auditors stole over Sh30 million from an Equity Bank branch in Othaya. A year later, another branch in Kayole was hit after robbers dug through the wall over several weeks to steal Sh27 million.

In both cases, suspicions pointed to inside help. These incidents suggest that while the current focus is on Equity Bank, the problem of bank security could be much wider.

Equity Bank has also faced a large internal fraud case involving payroll. The bank discovered that about Sh1.5 billion had been stolen, leading to the dismissal of nearly 200 employees. This showed that internal systems at the bank were not strong enough to detect or stop the fraud early.

Such issues only add weight to the concerns raised on social media.

While Equity Bank has recently received ISO certification for improving digital security, these steps may not be enough to address physical safety concerns for customers.

Cash transactions remain common, and without strong systems in place, customers will remain at risk.

Add Comment