Kenya’s Finance Bill 2025 has caused public concern following a controversial proposal allowing the Kenya Revenue Authority (KRA) to access private financial data without needing court orders. This includes sensitive information like bank transactions and M-Pesa records. The move is part of the government’s broader plan to increase tax compliance and close loopholes in revenue collection.

While the bill aims to boost government income and enforce accountability among taxpayers, many Kenyans feel that the government is taking things too far.

At the center of the issue is the proposal to remove Section 59A(1B) of the Tax Procedures Act. This clause currently protects personal and business data by requiring KRA to obtain court approval before accessing such information. If the bill passes, KRA will be able to collect data directly from businesses and financial institutions without judicial oversight.

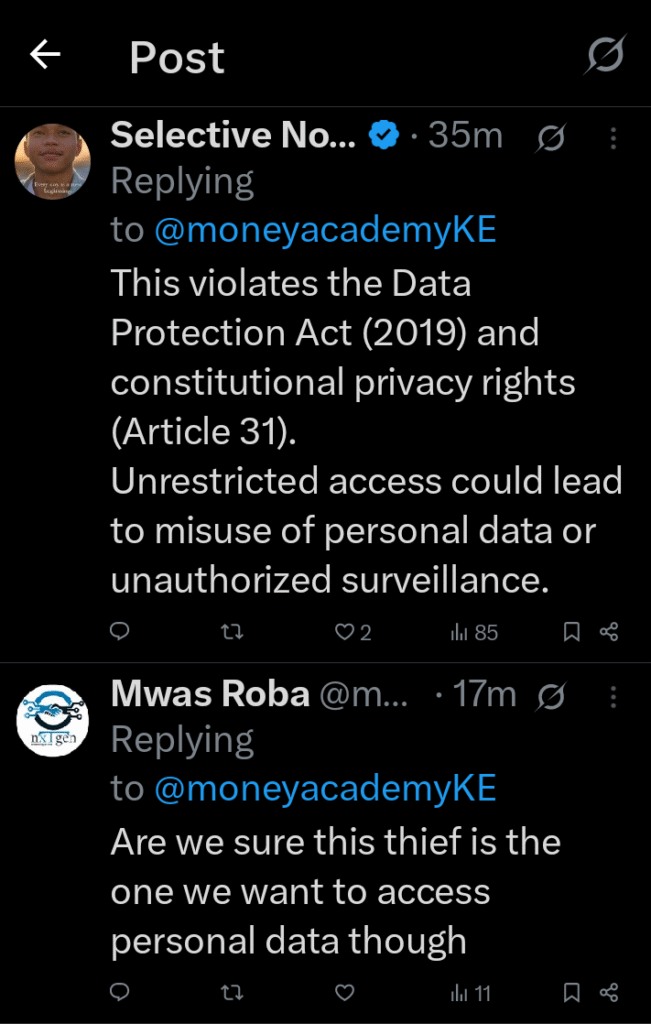

This development has alarmed both privacy advocates and ordinary citizens. Critics argue that the proposal goes against Article 31 of the Constitution, which safeguards the right to privacy, and the Data Protection Act of 2019, which outlines strict rules for handling personal data.Online platforms have become the main space where Kenyans express their frustrations.

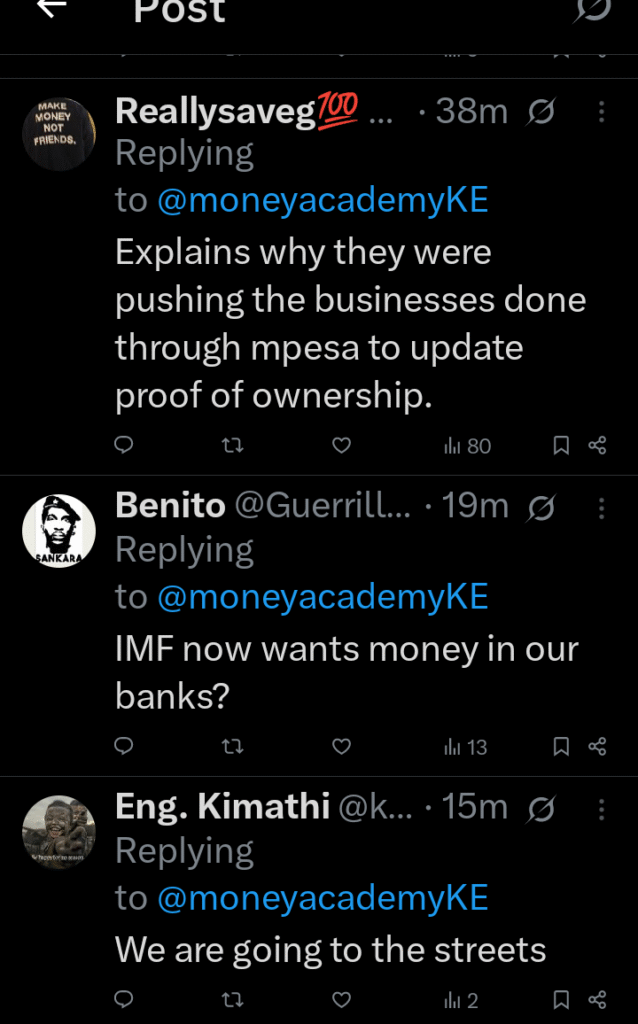

A post on X by @moneyacademyKE calling out the proposal received heavy reactions. One user described the move as “financial terrorism,” while others warned of possible misuse of power and questioned the safety of their personal information. Concerns are not just about privacy violations but also about the possibility of unauthorized surveillance and data leaks. Many fear that once KRA has unchecked access to people’s financial lives, it opens a dangerous door that might be hard to close.

This isn’t the first time the government has attempted such a move. In 2024, a similar clause was introduced in the Finance Bill but had to be removed after strong public backlash. The Kenya National Chamber of Commerce and Industry argued then that the existing system requiring court orders was fair and adequate. The government backed down, likely recognizing the strength of public opinion.

Now, barely a year later, the same idea is back, raising questions about whether lessons from the past have been ignored.Experts say that while increasing tax compliance is a legitimate goal, it should not come at the expense of individual rights. Financial and legal analysts warn that the proposal could have unintended effects, such as people withdrawing from digital transactions or mistrusting government systems. Businesses that rely heavily on mobile payments, especially through M-Pesa, could be particularly vulnerable if clients start fearing their data isn’t safe.

Some have even speculated that international pressure, possibly from donors like the IMF, may be influencing the government’s aggressive push for tax reforms. Despite the government’s intentions, public opposition to the proposal seems strong. Many citizens feel that trust and privacy should come before tax enforcement. There is a growing demand for the National Assembly to reject the proposal, and some activists are even threatening protests if it is not dropped.

As of May 2, 2025, the bill remains under parliamentary review, and the final decision has not been made. But if the reaction online and in civil society is anything to go by, this proposal might face the same fate as the one in 2024 unless the government decides to listen to its people.

Add Comment