A growing storm is brewing among tea farmers across Kenya who feel betrayed by the very institution that was supposed to uplift them. Greenland Fedha Limited, a microfinance company fully owned by the Kenya Tea Development Agency (KTDA), is now under heavy criticism from small-scale farmers.

According to recent reports by Cyprian Nyakundi, many of these farmers are accusing the lender of trapping them in predatory loan schemes that are both confusing and financially draining. This has raised alarm in tea-growing regions, where the once-promising credit facility has now turned into what some are calling a financial trap.

Greenland Fedha was initially created to support tea farmers by giving them easy access to loans for farming, education, and development. The idea was that loans would be recovered through monthly deductions from the farmers’ tea payments.

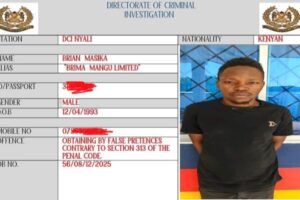

However, many farmers now claim that their debts are growing even when they repay regularly. One farmer who took a Kshs 30,000 loan in November last year says that despite Green Fedha deducting 30% from their tea earnings every month, the loan has already grown to Kshs 42,120. That means the farmer has paid for nearly a year, yet the debt has increased by over Kshs 12,000.

This has raised serious questions about the interest rate, transparency, and the way balances are calculated.

As per the reports by Cyprian Nyakundi, farmers are speaking out more loudly in local forums and online platforms. They describe how Green Fedha’s system is full of unexplained deductions, unclear loan balances, and interest charges that seem to go against the public claims made by KTDA.

For instance, in 2021, KTDA announced that Green Fedha would lower its interest rates from 21% to 8%. But many farmers say their statements don’t reflect this change, and they suspect that the institution is not following through with its promises.

There is also concern that Green Fedha has edged out better alternatives. Farmers complain that because KTDA backs Green Fedha, it has been allowed to dominate the market while making it harder for more transparent SACCOs and commercial banks to serve farmers.

Some farmers now believe that Green Fedha is shielded from government probing and regulatory checks, giving it the power to exploit farmers without facing consequences.

Calls are growing for the Ministry of Agriculture and SASRA to step in and audit Green Fedha’s operations. Farmers want answers. They want to understand how a loan that is supposed to help them ends up sinking them deeper into debt. They want leadership changes and more transparency. Above all, they want to be protected from what they describe as a system built to benefit a few at the expense of many.

The situation is growing worse as more farmers come forward with similar stories. It’s no longer about isolated cases. It’s a pattern that shows deep problems in the way small-scale tea farmers are treated by institutions meant to support them.

It is time for these institutions to face serious questions and be held accountable. What started as a helpful initiative has now turned into a bitter experience for many farmers who only wanted to grow their livelihoods through honest work.

Add Comment