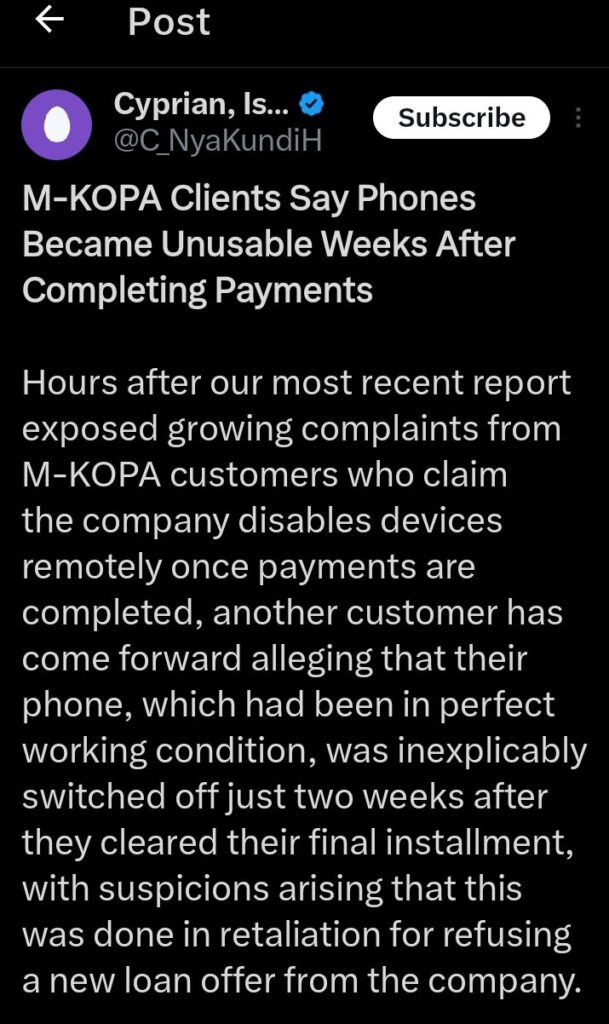

Cyprian Is Nyakundi has once again exposed another scandal involving M-Kopa, with fresh claims from a customer whose phone became unusable just two weeks after completing the final payment.

The customer alleges that M-Kopa deliberately disabled the device after they refused a new loan offer from the company. This follows a pattern where many clients have reported similar experiences, raising serious concerns about the company’s unethical business practices.

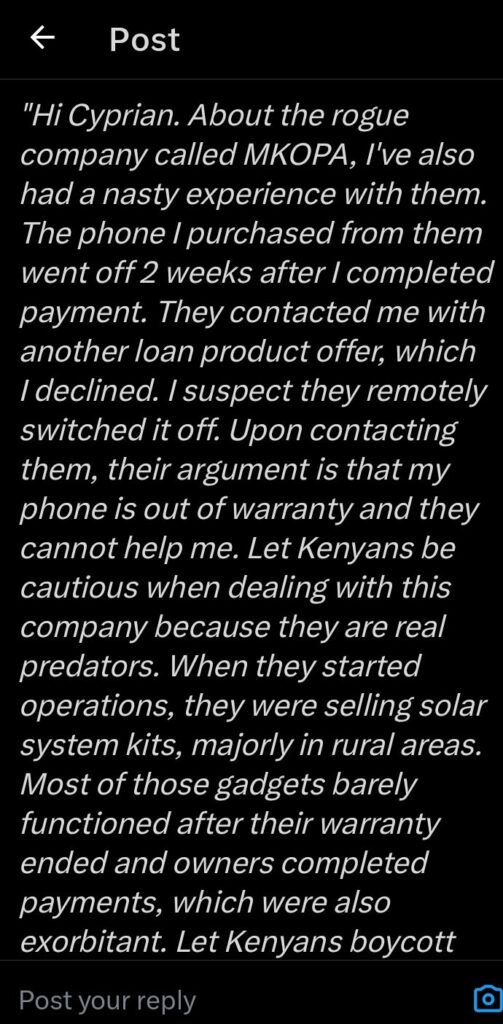

The affected customer shared their frustration after reaching out to M-Kopa for assistance, only to be told that the phone was no longer under warranty. This meant the company refused to take any responsibility for the sudden malfunction, leaving the customer with no option but to either pay for costly repairs or abandon the device entirely.

Many customers are now convinced that M-Kopa is intentionally sabotaging devices after payments are completed to force people into taking new loans.

These new allegations add to the growing anger among Kenyans who have fallen victim to M-Kopa’s exploitative business model. The company initially gained popularity by selling solar home systems to rural households on a pay-as-you-go basis, promising affordability and accessibility.

However, many customers later realized that the products barely lasted beyond the warranty period, despite paying hefty amounts over time.

Once payments were completed, the solar systems either failed completely or required expensive repairs, leaving many rural households in financial distress. Now, it appears that the same exploitative strategy is being applied to M-Kopa’s smartphone financing scheme.

Customers who thought they were securing long-term ownership of their devices are instead finding themselves stuck with useless phones just weeks after completing payments. The latest case only reinforces suspicions that the company remotely disables devices to push customers into taking more loans, ensuring they remain trapped in a cycle of debt.

Beyond the complaints about device failures, M-Kopa has also been accused of imposing harsh repayment terms, locking devices over minor delays, and offering poor customer support.

Many Kenyans who have tried to raise complaints about unfair treatment say they are met with automated responses and unhelpful customer service representatives who only repeat company policies without offering real solutions.

Customers who refuse to take additional loans or question company policies often find themselves locked out of their phones or facing sudden technical issues that M-Kopa refuses to address.

Kenyans are now calling for urgent action against M-Kopa to prevent more consumers from being exploited. Many believe that the government and consumer protection agencies should investigate the company’s practices and hold it accountable for the growing number of complaints.

Others are urging people to completely avoid M-Kopa products to prevent falling into financial traps. The latest revelations only confirm what many have suspected for a long time that M-Kopa is more interested in keeping customers in debt than in providing genuine financial empowerment.

Add Comment