Safaricom has recently come under fire for its handling of customer complaints and allegations of negligence, sparking outrage among Kenyans.

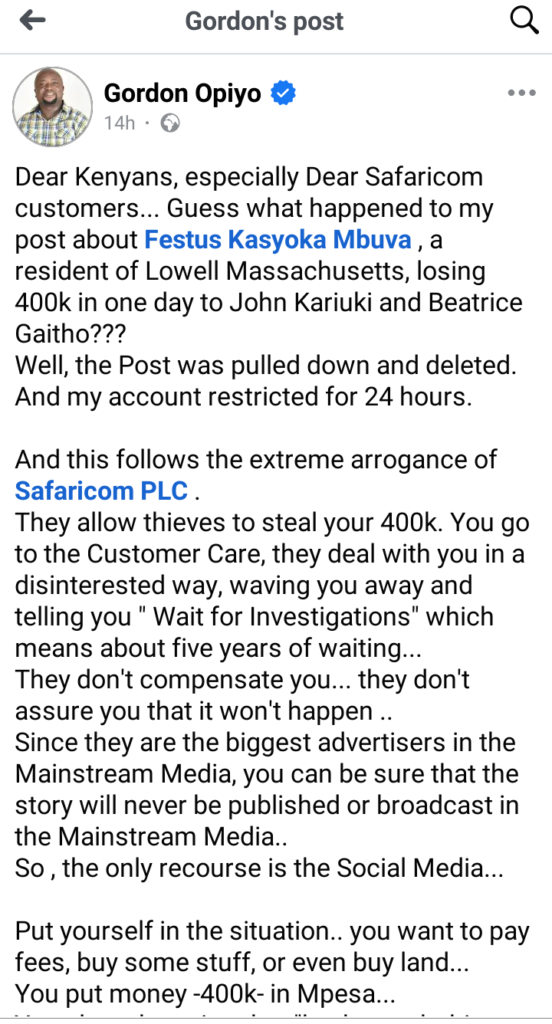

One notable incident involved Festus Kasyoka Mbuva, a resident of Lowell, Massachusetts, who reportedly lost Ksh 400,000 in a single day to fraudsters John Kariuki and Beatrice Gaitho.

Despite raising the alarm on social media, Mbuva’s post was allegedly deleted, and his account restricted for 24 hours.

This move has raised serious questions about Safaricom’s priorities and its commitment to addressing the concerns of its customers.

Many customers have voiced frustrations about Safaricom’s apparent indifference when such cases are reported.

Victims claim they are often met with disinterested responses from customer care representatives, who offer vague assurances to “wait for investigations.”

These investigations, according to some, drag on for years without any tangible resolution.

In the meantime, the victims are left with no compensation or reassurance that such incidents will not occur again.

This lack of accountability has tarnished the company’s reputation as the leading telecommunications provider in Kenya.

What adds insult to injury is Safaricom’s perceived use of its advertising power to suppress negative press.

As one of the biggest advertisers in mainstream media, the company is accused of leveraging its financial clout to ensure stories exposing its shortcomings never see the light of day.

For many, social media has become the only platform to air grievances, but even there, critics allege censorship and intimidation.

This raises concerns about freedom of expression and Safaricom’s willingness to silence dissent instead of addressing genuine customer concerns.

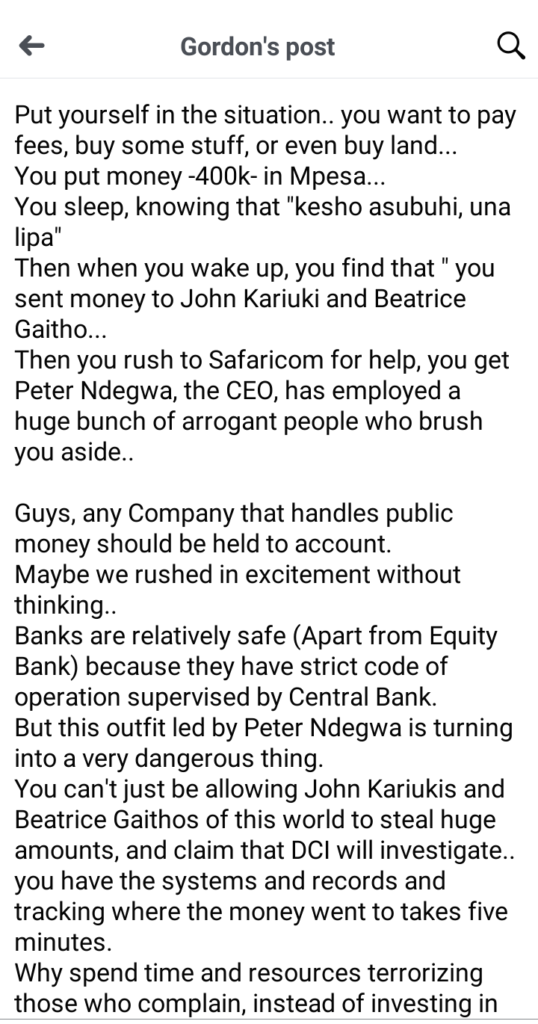

Consider the gravity of such a situation.

A customer deposits a substantial amount of money into M-Pesa, trusting the platform to be secure.

They plan to pay school fees, buy property, or meet other financial obligations.

However, they wake up to find their hard-earned money has been transferred to unknown individuals.

In their quest for justice, they are met with indifference, brushed aside, and left without answers.

This cycle of negligence and arrogance reflects poorly on Safaricom’s leadership, particularly its CEO Peter Ndegwa, whose tenure has been increasingly marked by such controversies.

Critics argue that any company handling public money must be held to the highest standards of accountability.

Unlike banks, which operate under the strict supervision of the Central Bank of Kenya, Safaricom seems to operate with minimal checks and balances.

This lack of oversight has made it a breeding ground for fraud and mismanagement.

Safaricom’s failure to track stolen funds and resolve cases quickly is especially troubling, given its access to advanced systems and records that should enable swift action.

Instead, resources appear to be spent on silencing complaints rather than improving customer service or enhancing security measures.

This pattern of behavior raises serious concerns about Safaricom’s priorities and its long-term sustainability.

Trust is the foundation of any financial or telecommunications institution, and Safaricom’s alleged neglect of its customers’ concerns risks eroding that trust.

Kenyans deserve better from a company that has positioned itself as an essential part of their daily lives.

Safaricom must address these issues head-on, implement robust measures to prevent fraud, and foster a culture of accountability.

Without major changes, its reputation will continue to deteriorate, leaving customers vulnerable and disillusioned.

Add Comment