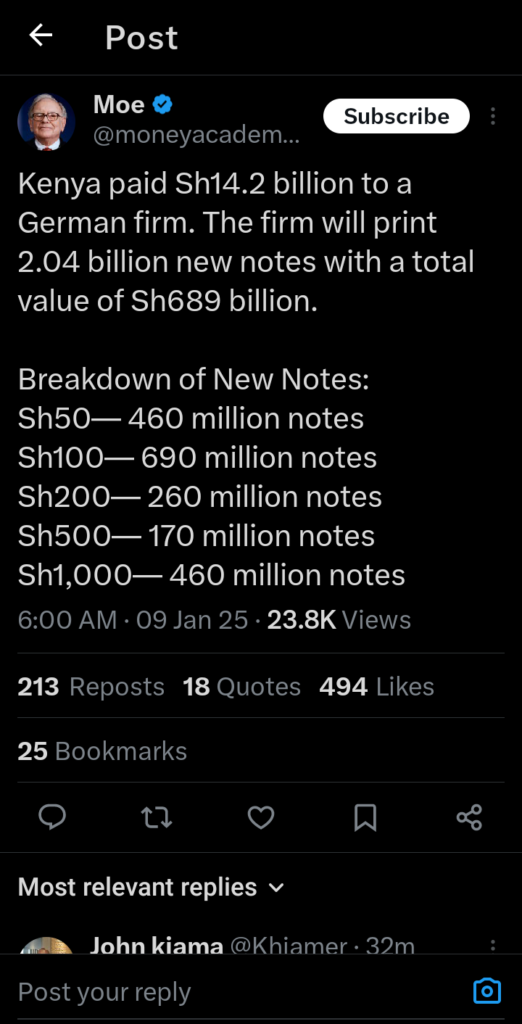

Kenya has entered into a sigagreement with the German company Giesecke+Devrient Currency Technologies GmbH (G+D) to print new currency notes.

The contract, valued at Sh14.2 billion, spans five years and aims to replace old and worn-out banknotes in circulation.

The Central Bank of Kenya (CBK) has outlined the specific quantities for each denomination to be produced under this contract:460 million notes of Sh50690 million notes of Sh100260 million notes of Sh200170 million notes of Sh500460 million notes of Sh1,000In total, 2.04 billion new notes will be printed, amounting to Sh689 billion in value.

This move comes after the previous currency printer, British firm De La Rue, ceased its Kenyan operations in early 2023 due to a lack of new orders.

The closure led to significant financial implications, including severance payments and asset write-offs totaling Sh2.4 billion.

The decision to engage G+D was made through a classified procurement process, approved by the National Security Council and the Cabinet.

CBK Governor Kamau Thugge explained that this approach was necessary to prevent a potential shortage of banknotes, which could have had serious economic and security consequences for the country.

The new banknotes will feature updated security measures, including color-changing security threads unique to each denomination.

They will also bear the signatures of CBK Governor Kamau Thugge and Treasury Principal Secretary Chris Kiptoo, with the year of print marked as 2024.

Despite these updates, the overall design will remain consistent with the 2019 series.

The cost of printing these new banknotes averages Sh6,842 ($53.5) per 1,000 pieces, representing an 11% increase compared to the Sh6,198 ($48) per 1,000 pieces for the 2019 series printed by De La Rue.

Governor Thugge noted that while there is an increase in cost, the procurement process was conducted in accordance with the Public Procurement and Disposal Act, with necessary approvals obtained.

Currently, there are about Sh330 billion worth of banknotes in circulation within Kenya.

Over time, currency notes become damaged or worn out, necessitating their replacement to maintain an adequate money supply in the economy.

The introduction of these new notes is part of CBK’s mandate to ensure there is the right amount of money in circulation, thereby supporting economic stability.

The new Sh1,000 notes, featuring enhanced security features, are already in circulation, with other denominations expected to follow in due course.

CBK has emphasized that the procurement process was transparent and conducted with the necessary approvals, aiming to maintain the integrity and security of the nation’s currency.

This development underscores Kenya’s commitment to maintaining a secure and efficient currency system, ensuring that the economy operates smoothly without disruptions caused by currency shortages.

The collaboration with Giesecke+Devrient Currency Technologies GmbH reflects a strategic move to uphold the quality and security of Kenyan banknotes in the years to come.

Add Comment