A recent incident involving NCBA Bank has raised serious concerns about the safety and security of customer funds.

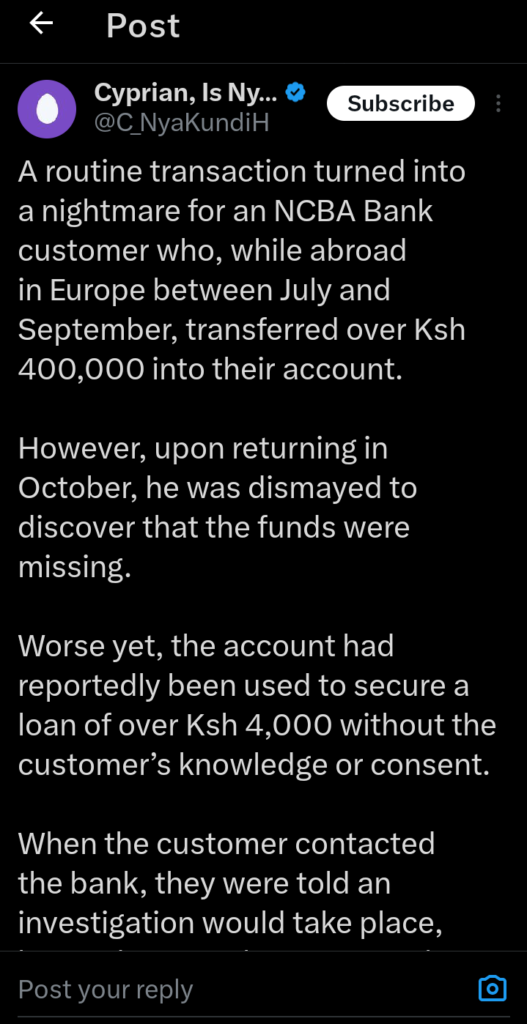

A customer, who was abroad in Europe between July and September, deposited over Ksh 400,000 into their NCBA account.

Upon returning in October, they were shocked to find that the entire amount was missing.

To make matters worse, the account had been used to secure a loan of over Ksh 4,000 without the customer’s knowledge or consent.

When the customer contacted the bank to report the issue, they were informed that an investigation would be conducted.

However, as of now, no clear answers or resolutions have been provided.

This lack of transparency and prompt action has left the customer frustrated and distrustful of the bank’s ability to safeguard their money.

This incident is not an isolated case.

There have been multiple reports of customers experiencing unauthorized transactions and delays in resolving such issues with NCBA Bank.

For instance, some customers have reported fraudulent activities on their accounts, such as unauthorized loans or withdrawals, which have led to financial losses.

The bank’s slow response in addressing these concerns has only exacerbated the situation, leading to a growing mistrust among its clientele.

The bank’s general terms and conditions outline the responsibilities of both the bank and the customer in safeguarding account information.

However, in this particular case, despite the customer’s prompt reporting, the bank has failed to provide a satisfactory resolution.

Moreover, the bank’s complaints handling guidelines state that they are committed to resolving customer complaints efficiently and transparently .

Yet, the lack of clear communication and delay in resolving this issue contradicts their stated commitment, further tarnishing their reputation. The financial sector relies heavily on trust and reliability.

When a bank fails to protect its customers’ funds and does not address issues promptly, it undermines the confidence that customers place in the institution.

NCBA Bank’s failure to provide clear answers and resolutions in this case raises questions about their internal security measures and customer service effectiveness.

In light of these events, customers are advised to monitor their accounts regularly and report any suspicious activities immediately.

It’s also prudent to familiarize oneself with the bank’s procedures for handling such incidents and to escalate the matter to higher authorities if satisfactory resolutions are not provided in a timely manner.

The recent incident involving the unauthorized withdrawal of funds and the unapproved loan on a customer’s account has tarnished NCBA Bank’s reputation.

The bank’s inability to provide clear answers and timely resolutions to such serious issues raises concerns about their commitment to customer security and satisfaction.

It is imperative for NCBA Bank to take immediate corrective actions to restore customer trust and ensure the safety of their clients’ funds.

Add Comment