Kenya’s economic history is rife with cases where political leaders have used their influence to benefit private businesses, often leaving ordinary citizens to bear the brunt of the financial consequences.

Former President Uhuru Kenyatta and current President William Ruto are two leaders whose ties to private enterprises have raised serious ethical and legal concerns.

These cases show how political power can be used to advance personal or allied business interests at the expense of public welfare.

During Uhuru Kenyatta’s presidency, the merger of Commercial Bank of Africa (CBA) and NIC Group led to the formation of NCBA Bank.

This merger, however, was accompanied by a Ksh 350 million tax waiver, sparking public outrage.

Critics argue that the waiver was a blatant misuse of presidential influence, as the Kenyatta family owned a big stake in CBA.

Activist and Senator Okiyah Omtatah challenged the legality of this decision, asserting that the then-Treasury Cabinet Secretary Henry Rotich did not have the authority to exempt taxes in this manner.

This waiver represented a substantial loss to the public, with funds that could have been used for essential government projects or services instead benefiting a private entity.

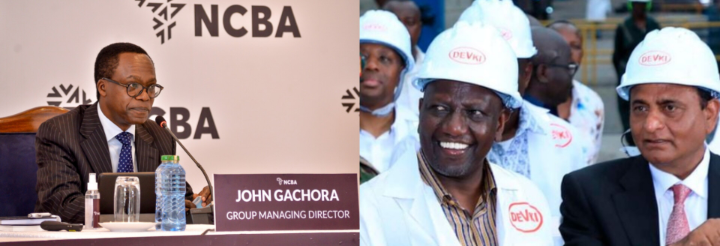

Defenders of the waiver, including NCBA Managing Director John Gachora, claimed it was necessary for the merger process, which involved over 26,000 shareholders.

However, this argument failed to quell suspicions of favoritism, especially since the Kenyatta family retained majority ownership in the merged entity.

The public saw this as yet another example of the wealthy elite benefiting from policies that disadvantage ordinary citizens.

While NCBA has stated its willingness to repay the waived taxes if the courts rule against it, many view this as a reactive approach, highlighting a lack of proactive accountability.

The incident tarnished Uhuru Kenyatta’s legacy, raising questions about his commitment to prioritizing national interests over personal gain.

On the other hand, President William Ruto’s close ties to billionaire Narendra Raval reveal a different but equally troubling story.

Raval, the owner of Devki Steel Mills, openly supported the controversial Finance Act of 2023, which introduced new taxes that burdened many Kenyans.

His company was even allowed to defend the Act in court, arguing that it would benefit local manufacturers.

And adding on top just recently president William Ruto has waived Raval in taxes amounting to over Kshs 11 billion.

This raised concerns about the undue influence of business tycoons on public policy.

While Raval framed his support as being in the interest of the economy, critics saw it as a strategic move to secure favor with the Ruto administration.

Such actions reinforce the perception that policies are often shaped to serve the interests of a privileged few, rather than addressing the struggles of ordinary Kenyans.

The cases of NCBA and Narendra Raval illustrate how political leaders and their allies manipulate economic systems for personal or allied gain.

Both Uhuru and Ruto have faced accusations of allowing private interests to influence public policy, leaving taxpayers to bear the consequences.

Add Comment