Whitepath Company, the owner of digital lending apps such as Zuri Cash, Instar Cash, and Skypesa, has repeatedly been accused of unethical practices that violate the Central Bank of Kenya (CBK) regulations, particularly the Amendment Act of 2021.

Despite being fined KSh 5 million last year, the company continues to operate with apparent impunity, disregarding both legal requirements and customer rights.

One of the primary issues with Whitepath is their misleading advertising.

They claim to offer loans with repayment periods of up to 90 days, but in reality, customers are only given a maximum of 8 days to repay their loans.

This misrepresentation is a clear violation of transparency requirements, as it misleads borrowers about the terms of their loans.

Furthermore, Whitepath fails to provide borrowers with receipts for their payments, making it difficult for customers to keep accurate records of their financial transactions.

The lack of proper documentation not only hinders borrowers but also raises questions about the company’s commitment to transparency and ethical business practices.

Another concern is the company’s failure to establish a proper mechanism for resolving customer complaints.

Borrowers have reported that their grievances are often ignored, leaving them without recourse when issues arise.

This lack of accountability further increases the problems faced by customers.

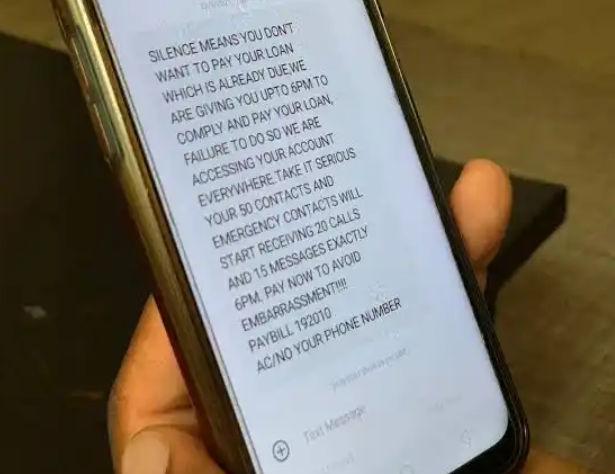

Whitepath is also notorious for its unethical debt collection practices.

The company has been accused of harassing, shaming, and even threatening borrowers and their contacts in an effort to force repayment.

This includes tactics like sending threatening messages to borrowers’ contacts and even creating WhatsApp groups to publicly shame defaulters.

These actions not only violate the CBK’s regulations but also Kenya’s Data Protection Act, which prohibits the sharing of personal data without consent.

The persistent misconduct of Whitepath highlights a broader issue within Kenya’s digital lending industry.

The company has faced numerous complaints, yet it continues to operate in a manner that undermines customer trust and flouts legal obligations.

It is crucial for the public to be aware of these misdeeds and exercise caution when dealing with companies like Whitepath.

Add Comment